Whether it’s just curiosity or you’re thinking of making an exit, many entrepreneurs like to know the value of their business. Finding an accurate valuation can also be a real challenge, given the number of factors at play.

Several methods can be used to ascertain the value of your business. In this post, we will go through the three main valuation methods:

- Multiple-Based Approach

- Discounted Cash Flow Analysis (DCF)

- Precedent Transactions

Earnings-Multiple

By far the most common valuation method for internet businesses is the use of earnings multiples. In a public company setting, this tends to manifest as P/E multiples as well as EV/EBITDA and EV/Sales or other iterations of these core metrics. In the internet business world, owners tend to use the multiple-based methodology because of its simplicity and robustness in the face of insufficient financial or comparable data.

The multiple-led method stipulates the buyer should arrive at a valuation by multiplying the seller’s discretionary cash flow (SDC) by a multiple that is appropriate for the business. Naturally, the “appropriate” multiple is where all parties seek to formulate their own opinion and hopefully (read: eventually) arrive at a consensus before consummating the deal. We will look at the factors that affect the multiple in greater detail later in the post.

In a nutshell:

- It is a simple and robust method

- It does not require a thorough financial history

- It considers a wide range of factors (Which we will look at later on)

Discounted Cash Flow Analysis

A discounted cash flow analysis (DCF) is one of the most detailed methods which involves predicting the free cash flows of your business. Those cash flows are then discounted by predetermined costs including interests on debt repayments and taxes. This is usually termed as the weighted average cost of capital (WACC).

The underlying principle is based on time value of money, which says that a dollar today is worth more than a dollar tomorrow.

This method suits mature, stable internet businesses with predictable cash flows. Due to the nature of internet businesses, few meet these requirements. Varying monthly cash flows, relative immaturity of the internet industry as a whole, and a lack of detailed financial history are all familiar challenges.

If you have one of those rare mature and stable internet businesses, then this could be the method for you.

In a nutshell:

- Requires a detailed financial history and mature business

- Follows the principle that a dollar today is worth more than a dollar tomorrow

- Relies on predictable cash flows

Precedent Transactions

This is a classic comparison method. Looking at precedent acquisitions is a good starting point when it comes to valuing your business. Typically, it’s used as a point of reference against more detailed checks, like the DCF or earnings multiple method.

It’s essential to identify and compare the right metrics as a valuation parameter for each deal, usually multiples of earnings or revenue.

For example, were the companies in those transactions valued as a multiple of EBIT, EBITDA, revenue, or some other parameter? If you figure out what the key valuation parameter is, you can examine at what multiples of those parameters the comparable companies were valued. You can then use a similar approach to value your business.

The primary requirement for arriving at an accurate valuation using this method is access to transaction data. For public companies, this type of information is abundant, but in the private world of internet M&A, this data is privately kept. Therefore, without using proper internet business brokers, this kind of method for valuations can prove tricky.

In a nutshell:

- A comparison method

- Better used in conjunction with other valuation methods

- Relies on data that can be privately held

Which Method?

As an internet business, the earnings multiple method would be the most likely option. It takes into account scant financial records, the variable monthly earnings, and it’s simple and robust.

The DCF analysis works for more mature businesses and relies on regular, predictable cash flows. As we all know, such situations are difficult to find in the world of internet businesses. If you do somehow manage to tick those boxes, then this method is a good option due to its detail.

The precedent transactions method can be used in conjunction with one of the other two, to confirm the valuation of your business, if you have access to the relevant data.

Factors Behind the Earnings Multiple

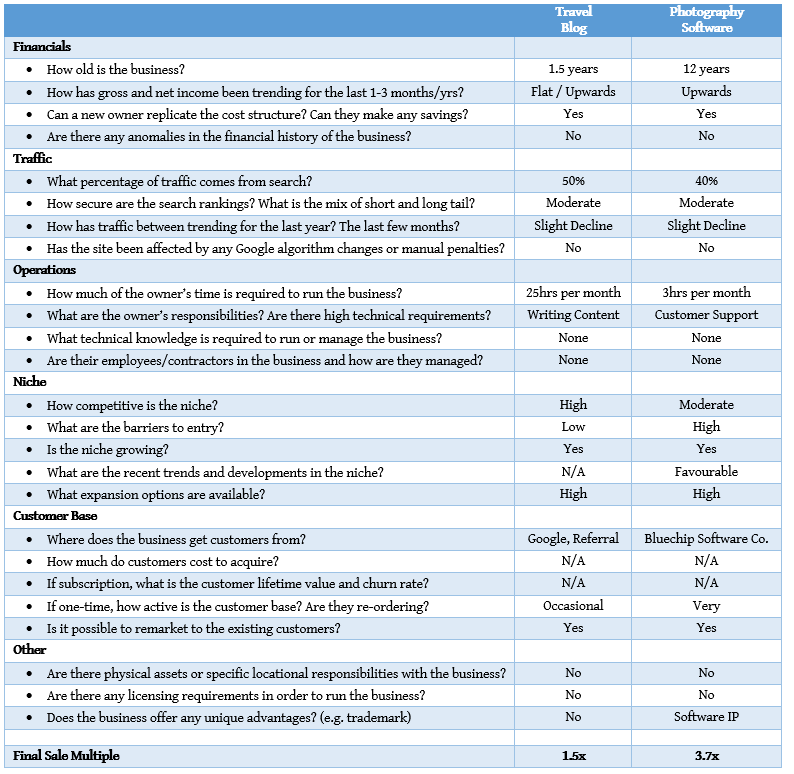

Given the options, it’s highly likely you will be adopting the earnings multiple method for your business. To begin with, let’s take a look at the different factors that will influence the value of your business:

As you will see, there is a whole range of valuation drivers. For an internet business, anything from the level of traffic to customer acquisition costs can have an impact. Therefore, you should take a few steps before you attempt to get an accurate valuation of your business.

Record Your Finances

Even though one of the advantages of the earnings multiple method is that we can get by without a full financial history, having one will certainly help improve the accuracy of the valuation. Having these financials at your fingertips could also drive up the value of your business for prospective buyers and investors.

Fortunately, there are many tools which can help with all elements of accounting such as bookkeeping, cash flow reporting, and profit-loss statements. Utilizing these tools will save you hours of work and avoid the tedious exercise of manually recording your financial data.

And at the end of it, you will have a set of financial records that you can use to value your business accurately.

Track Your Traffic

As an internet business, traffic to your site will be central to the final valuation. How much traffic do you get each month? How much of it is recurring or new? How long do people stay on your site? Each of these questions, and more need to be answered.

At a minimum, you should use Google Analytics from day one. It’s a free, comprehensive tool that can answer all the necessary questions. It also looks at the sources of your traffic, assesses competition for keywords, and identifies any vulnerabilities to changes in Google’s search algorithms.

Traffic is the factor that makes or breaks an internet business. Without the relevant information, it will be impossible to arrive at an accurate valuation.

Owner Involvement

This factor depends on what you want to do with your business. If you are happy to stay in for the long-term and grow your company, then as an owner you can be as involved as you like. And a lot of business owners are understandably heavily involved.

If you are looking to make an exit - then you need to consider limiting your involvement. This can be a difficult undertaking, as it can feel like handing over your baby to other people. However, it’s important to understand to maximize the value of your business, you need to show potential buyers and investors that they do not need to spend more than ten hours a week running it.

Most buyers and investors are looking for a passive income. If your business can provide this, then a premium will be added to the final valuation.

Other Factors at Play

These are just three of the factors that you can influence. However, as we’ve seen earlier, there are many others. Here’s a quick chart which explains how each of these factors can impact on the final multiple:

The process can seem complex, and in some ways it is. Internet businesses tend to be highly sensitive, and therefore each of these factors needs to be considered. In short, you need to follow the old principle of recording every transaction and monitoring all traffic.

Fortunately, we have 21st-century solutions which can make all this a far easier and more automated task.

Related Articles

How to Set Up Consent Mode in GA4 on Your Website with Google Tag Manager

Let's explore how to properly integrate consent mode in GA4, configure it for effective data collection, and at the same time comply with GDPR and other legal regulations

Display Advertising Effectiveness Analysis: A Comprehensive Approach to Measuring Its Impact

In this article, I will explain why you shouldn’t underestimate display advertising and how to analyze its impact using Google Analytics 4

Generative Engine Optimization: What Businesses Get From Ranking in SearchGPT

Companies that master SearchGPT SEO and generative engine optimization will capture high-intent traffic from users seeking direct, authoritative answers