ROI, or return on investment, is a key performance indicator that measures the ratio between net income and investment in analytics. By learning how to properly calculate and interpret ROI, companies can make informed decisions about their financial strategies. In this article, I will discuss the basics of ROI, how to calculate it, and provide examples of its use in various industries.

What is ROI?

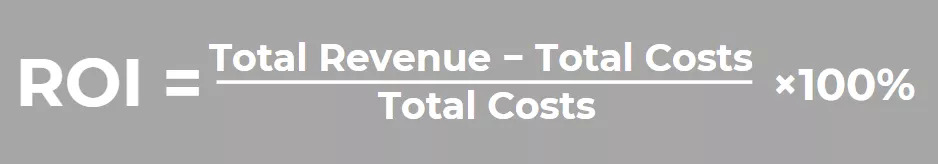

Return on investment (ROI) is a metric that determines the effectiveness of an investment by measuring the ratio of revenue to costs. It helps businesses evaluate the return on their investments and make informed financial decisions. ROI is calculated using the formula below:

Revenue is the total amount of money received from an investment.

Investment is the amount of money invested in a project or campaign.

Types of ROI

You can calculate the effectiveness of investments for the entire company as well as for a specific line of business or project. The most common types of ROI are ROMI and ROAS.

ROMI (Return on Marketing Investment)

This metric measures the effectiveness of marketing costs. It helps companies understand how well their marketing campaigns generate revenue compared to marketing costs. Essentially, ROMI allows you to make informed budgeting decisions and optimize marketing strategies.

ROAS (Return on Advertising Spend)

ROAS measures the effectiveness of advertising costs. This metric indicates how much revenue is generated for each unit of currency spent on advertising. ROAS is useful for evaluating the profitability of individual advertising campaigns and for optimizing advertising costs.

ROAS focuses solely on advertising costs. Conversely, ROMI takes into account all marketing costs, including research, product development, and promotion.

How to interpret ROI calculations

- A positive ROI (above 0) means that the investment has been profitable. The higher the value, the more efficient the investment.

- A zero ROI means that the investment has only returned the invested funds without any additional profit. You did not make any extra money, but you did not lose any either.

- A negative ROI (less than 0) means that the investment was unprofitable. You lost some or all of your investment.

Examples of ROI calculation

- John invested 1000 UAH in an advertising campaign and received 2700 UAH in revenue from conversions.

ROI = (2700–1000) / 1000 х 100% = 170%.

This is a positive indicator; the investment paid off. - Stacy invested $1000 in a new product and received $1000 in revenue.

ROI = (1000–1000) / 1000 х 100% = 0%.

This is a zero value; the investment only returned the money invested. - Adam spent $5000 to develop an application but only received $800 in revenue.

ROI = (800–5000) / 5000 х 100% = –84%.

This is a negative indicator; he lost 84% of the money he invested.

Understanding and interpreting ROI can help you make informed investment decisions and improve cost efficiency.

Pros and cons of the ROI metric

|

Pros |

Cons |

|

Easy to use. This makes the ROI formula suitable for quick analysis of investment efficiency. |

Time factor. ROI does not take into account the period during which the investment was made. An investment can have a 30% ROI in a month and in a year, but the efficiency of these investments is different. |

|

Versatile. You can use ROI to analyze marketing campaigns, projects, equipment purchases, and other costs. |

Does not account for risk. The cost of a marketing campaign can increase due to unpredictable changes in the market, a competitor's advertising campaign, technical problems, or campaign implementation failures that are not accounted for in the basic calculation. |

|

You can compare the performance of different investments, helping you make informed decisions about resource allocation. |

Limited data. ROI provides only a general idea of the financial efficiency of investments — it does not take into account other important factors. For example, an investment in upgrading computers or other office equipment may have a negative ROI but may reduce HR costs in the long run. |

|

You can evaluate the ROI, which can help you decide whether to change the strategy or keep it as it is. |

Possibility of manipulation. Choosing certain income and expense indicators can lead to a distorted assessment of efficiency. For example, if you do not take all expenses into account, you will artificially increase the ROI, but this will not be an accurate indicator. |

Tools to automatically calculate ROI

- Google Analytics 4 allows you to calculate ROI in a custom report. However, it has one limitation: despite the correct percentage calculation, the system will display the currency as the unit of measurement.

- HubSpot offers comprehensive marketing management tools that include ROI calculation capabilities. It allows you to track the effectiveness of marketing campaigns, analyze leads, and monitor their conversion into sales.

- Moz Pro helps you track and analyze the effectiveness of your SEO campaigns. It allows you to calculate ROI, track search engine rankings, and analyze traffic and conversions.

- Kissmetrics provides an in-depth analysis of user behavior on your website, which makes it easy to calculate ROI for various marketing activities. The tool allows you to track conversions, analyze customer journeys, and determine the effectiveness of different channels.

- AdRoll specializes in retargeting and digital advertising. By providing tools for calculating ROAS, it allows you to track ad performance, analyze audiences, and optimize budgets.

ROI best practices

- Consistently measure ROI. ROI allows you to determine which initiatives bring the most profit and make informed decisions about resource allocation.

- Compare alternative investments. For example, you can compare the effectiveness of different marketing campaigns or projects to determine the most profitable ones.

- Monitor results. Identify problems in ongoing projects and campaigns and make adjustments to improve profitability.

- Make strategic decisions. ROI can help you assess the potential benefits of new projects and activities, contributing to sustainable business growth.

Common mistakes when calculating ROI

- Not including all costs. Ignoring hidden or additional costs associated with a project leads to incorrect calculations.

- Short-term approach. Evaluating only short-term results hides the true effectiveness of investments.

- Incorrect definition of revenue. Including revenues that are not a direct result of the investment increases the ROI falsely.

- Using incorrect data. Inaccurate or incomplete data significantly distorts the results of calculations.

- Failure to account for variable factors. Ignoring external factors, such as economic conditions or market trends, may affect ROI values.

- Mixing different time periods. Comparing ROI across different periods without considering changes in costs or revenues for those periods will lead to incorrect measurements.

An example of an incorrect ROI calculation

John spent $2000 on advertising and received $2500 in profit. In his calculation, the ROI is 25% and is a positive indicator. However, in addition to advertising costs, John spent another $300 on content creation and $200 on analytics, which he ignored in his calculation. The actual cost of the project is $2500 and the ROI is 0%.

Conclusions

- ROI, or return on investment, is a metric that determines the effectiveness of investments by measuring the ratio of profit to cost.

- You can calculate the efficiency of investments both for the entire company and for separate areas or projects.

- An ROI greater than zero is positive and indicates a payback. An ROI of zero means that the investment has been returned, but no profit has been made. Conversely, an ROI of less than zero indicates a loss.

- ROI is easy to calculate, versatile, and allows you to compare performance and assess return on investment. At the same time, it does not take into account risks and external factors. It is also easy to manipulate.

- There are tools available to automatically calculate ROI, such as Google Analytics, HubSpot, Moz Pro, and others.

FAQ

What does an ROI of 20% mean?

If you invested $1000 in a project and made a profit of $1200, your ROI is 20%. Every dollar invested produced 20 cents of profit. Your investment was effective and generated added value.

What is a good ROI?

A good return on investment (ROI) varies depending on the industry and the type of investment. An ROI of 10–15% is considered a good rate.

What is an annual ROI?

An annual ROI measures the return on investment for a year. It is a useful metric for comparing the effectiveness of different investments or tracking changes in profitability over time. The annual ROI is calculated by dividing the total return by the number of years the investment has been active.

Recommended theme posts

Related Articles

How to Set Up Consent Mode in GA4 on Your Website with Google Tag Manager

Let's explore how to properly integrate consent mode in GA4, configure it for effective data collection, and at the same time comply with GDPR and other legal regulations

Display Advertising Effectiveness Analysis: A Comprehensive Approach to Measuring Its Impact

In this article, I will explain why you shouldn’t underestimate display advertising and how to analyze its impact using Google Analytics 4

Generative Engine Optimization: What Businesses Get From Ranking in SearchGPT

Companies that master SearchGPT SEO and generative engine optimization will capture high-intent traffic from users seeking direct, authoritative answers