Why Iconic Brands Don’t Do Discounts and Price Wars — Your Amazon Fashion Guide

Iconic fashion brands don’t compete on price — because they don’t have to.

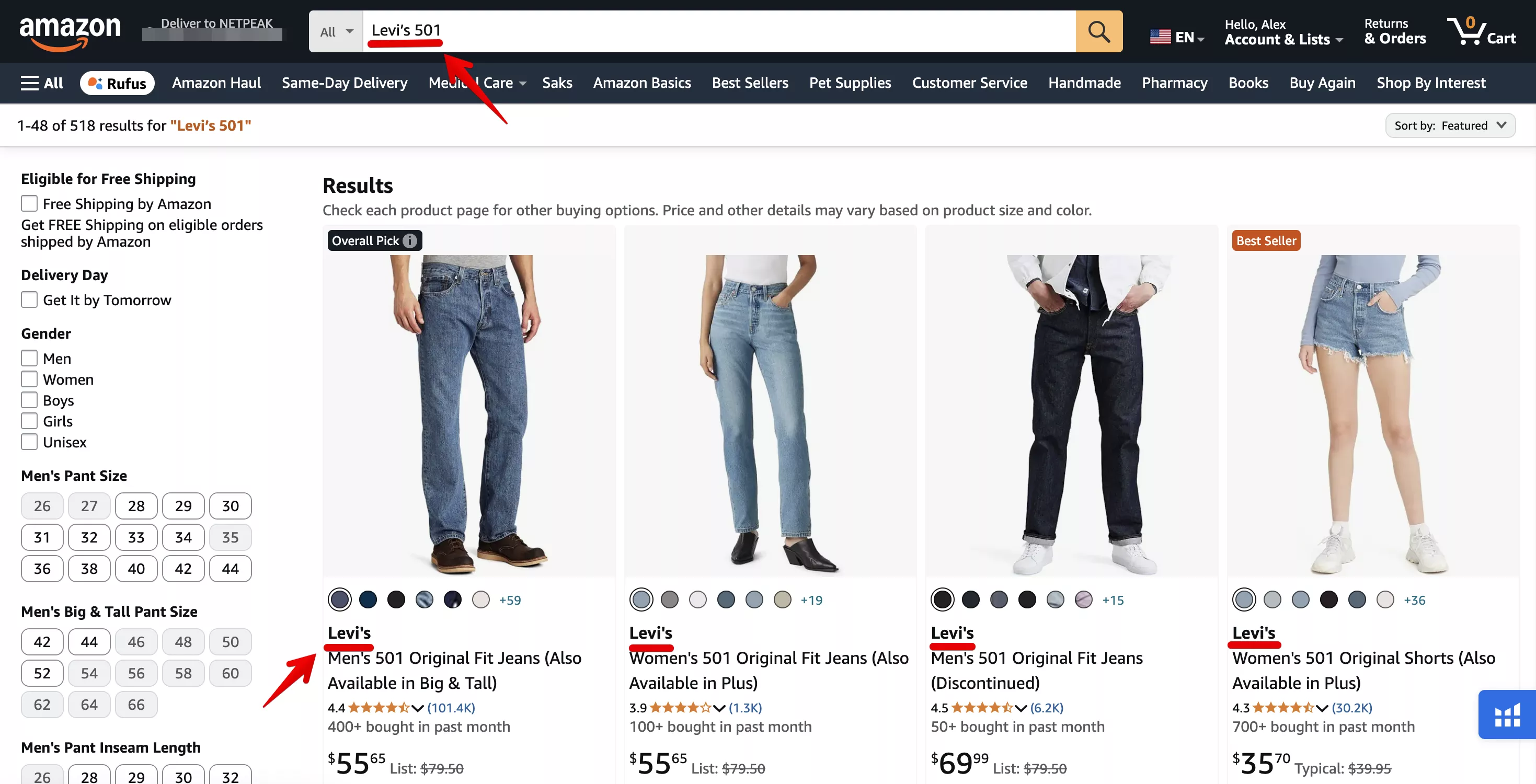

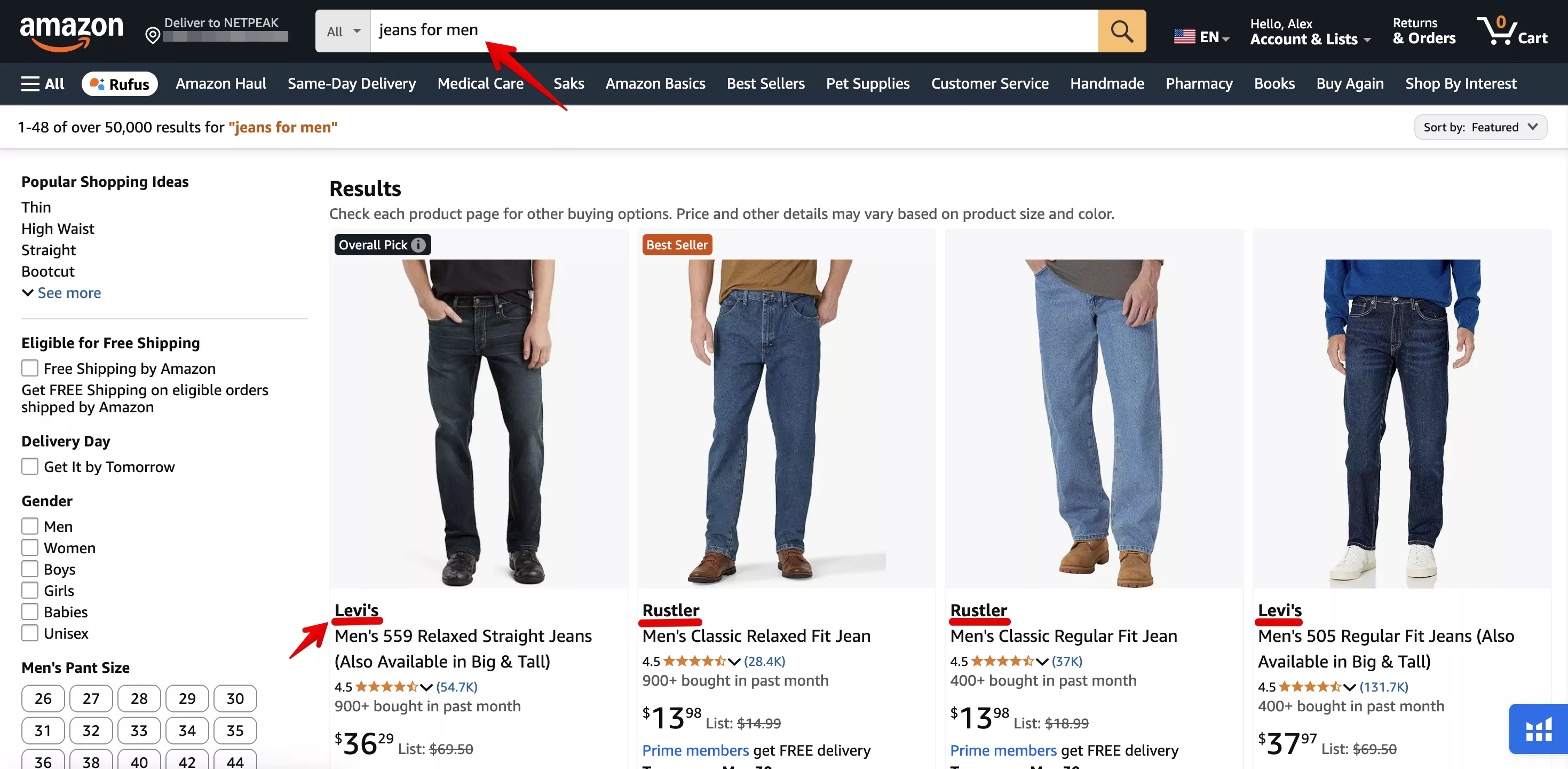

They’ve built recognition, trust and emotional relevance that pull shoppers in before the price tag even enters the chat. On Amazon, that means their listings convert not because they’re cheaper — but because they’re chosen. When a buyer searches for “Levi’s 501” or “Calvin Klein bralette,” they’re not weighing options. They’re confirming a decision they already made in their head (and probably in their hearts).

Amazon SERP for “Levi’s 501” vs. “jeans for men”

Discounting is a tactic for indistinct brands desperate to win attention without delivering value. But in fashion, attention without identity is like runway without attitude — forgettable. Price wars only accelerate the death spiral of commoditization, especially in categories like basics and streetwear where copycats flood search results.

Iconic brands sidestep this trap by owning their positioning. They use creative, messaging and campaign logic to signal “This is what you’re here for. Everything else is a dupe.”

What they understand — and most smaller brands miss — is that pricing power isn’t about margins. It’s about memory. And if your customer doesn’t remember you after purchase, you’re just a cheaper option waiting to be replaced.

In short? Iconic brands don’t discount to survive. They differentiate to stay untouchable.

Lost in the Scroll: Why Fashion Brands Need Emotional Relevance on Amazon

Fashion brands on Amazon face a chronic issue — not visibility, but visibility without impact. SEO and PPC might drive traffic, but traffic alone doesn’t convert when every brand looks and sounds the same. Shoppers click, scroll and browse … then bounce. The problem isn’t performance marketing. It’s the absence of emotional relevance.

And in fashion, emotional relevance is the product. Shoppers don’t want just a hoodie or a dress — they want to feel something. They want to see themselves in a brand’s values, mood and lifestyle. But Amazon flattens all that. It reduces fashion to filters, thumbnails and rating counts — erasing the very things that create brand preference.

Even heritage names like Levi’s and Calvin Klein aren’t immune. Levi’s still wins clicks thanks to decades of equity and search dominance — but its listings lean heavily on search volume and price, not storytelling. Calvin Klein relies on name recognition but often lacks narrative. Amazon’s own label, The Drop, plays the game differently: micro-drops, influencer collabs, scarcity — it’s built to thrive within Amazon's rules. That’s rare.

Smaller and emerging brands? No benefit of the doubt. No recognition bump. Without intentional differentiation baked into every layer — from search strategy to visuals to messaging — they’re just another rectangle in the scroll. No matter how good the product is, it won’t matter if the shopper can’t tell it apart from a private-label knockoff.

Fashion on Amazon Trips on Its Own Runway

Fashion is one of the rare categories on Amazon where logic doesn’t win — emotion does. Shoppers aren’t just comparing price points or spec sheets. They’re sizing up identity. They want to know: Does this brand get me? Will this look say what I want it to say?

But Amazon’s infrastructure wasn’t built for emotional connection — it was built for logical comparison. Search filters, product grids and algorithmic suggestions all nudge shoppers toward efficiency, not inspiration. For fashion brands trying to sell mood, styling or self-expression, the system works against them from the start.

It gets worse. Fashion is one of Amazon’s most saturated, most rapidly cloned categories. Private labels move at lightning speed, using real-time search data to copy trending products. If a piece from The Drop blows up on TikTok, dozens of lower-priced knockoffs hit the marketplace within days — SEO-optimized, aggressively advertised and ready to steal traffic before the original brand even finishes celebrating.

Meanwhile, Amazon offers almost no space to showcase what actually matters in fashion: fit, feel, vibe. You can’t show how a dress moves, how a jacket layers or how a piece fits into a lifestyle directly on a search results page. Most Enhanced Brand Content (EBC) is still painfully generic — a grid of facts when what the customer really wants is a feeling. And since bullet points are often skipped unless they deliver high perceived value quickly, brands are left with the thinnest sliver of opportunity to make a real emotional impression before the shopper scrolls away.

Strong Visibility, Weak Results: The Story of a Brand Without a Story

In the short term, fashion brands often see strong visibility — but weak results. They rank well, run Sponsored Product ads and get plenty of clicks ... but conversions lag. Shoppers bail. The product looks nice — but it’s not memorable. Mid-tier brands like Daily Ritual or Goodthreads illustrate this gap perfectly: decent design, solid fundamentals, yet they struggle in flooded categories where everything looks the same at first glance. The result? Wasted ad spend, discount spirals and an all-too-familiar race to the bottom.

Brands often respond with surface-level fixes — A+ content refreshes, slightly shinier imagery, a title tweak here and there. But that doesn’t solve the real issue. Because the problem isn’t the pixels — it’s the positioning. Without a clear angle or brand narrative, no amount of creative optimization can save a listing that doesn’t mean anything to the customer.

Long term, this creates compounding damage. Brands become dependent on advertising to sustain visibility, eroding margins. Differentiation fades, and with it, pricing power and customer loyalty. Even if a brand achieves short-term success, it’s not defensible. The moment ad spend drops or a new competitor enters with similar creative and lower pricing, market share disappears.

And because Amazon doesn’t naturally encourage brand recall or loyalty, lifetime value doesn’t materialize unless it’s deliberately engineered. That’s the hidden cost of blending in: not just lower performance, but performance that can collapse at any moment.

Pretty Pictures, Empty Promises: Why Differentiation Efforts Fall Apart

Most fashion brands on Amazon try to fix differentiation problems with surface-level tweaks. They swap out images. They tweak a headline. They throw more money into ad campaigns. But these are just outputs — not strategy.

The real problem — a total lack of emotional relevance — stays untouched.

Amazon flattens everything into function: grids, filters, bullet points. Without a brand story built to survive that flattening, no amount of pretty pictures or keyword stuffing can save you. Brands keep polishing the outside, but the inside is empty. And customers can tell. That’s why the fixes fall flat — and why, no matter how much they optimize, nothing really changes.

High Gloss, Low Impact: The Typical Fixes That Fashion Brands Default To

When brands try to solve the differentiation problem, they usually reach for the same worn-out playbook:

- Update product imagery

- Launch Sponsored Brand or Sponsored Video ads

- Add Enhanced Brand Content (EBC)

- Run seasonal promos or discounts

But here’s the hard truth: These are execution tools — not strategy. They dress up the packaging, but they don’t fix what’s broken underneath.

All Dressed Up With Nowhere to Go: Why Most Fashion Fixes Fizzle

Because they operate in isolation.

A Sponsored Brand ad might drive traffic — but if the listing doesn’t have a strong point of view, shoppers bounce.

Enhanced Brand Content might polish your page — but if the message feels generic, customers tune it out.

Discounting might bump sales — but it cheapens the brand and speeds up the race to the bottom.

Even powerhouse names like Champion and Adidas Originals struggle when they don’t translate their lifestyle identity into Amazon-native language. A polished image alone isn’t enough. On Amazon, your value proposition needs to punch through in milliseconds — and it has to hit in context. Otherwise? Your shoppers keep scrolling.

“Brands love to throw money at Sponsored Brands, A+ content and glossy images like it’ll magically fix weak positioning. It won’t. If your listing doesn’t answer ‘why this product, why now’ in three seconds, no amount of polish will save it. Shoppers don’t reward effort — they reward clarity.”

Anton Tochylo,

Marketplace Promotion Team Lead at Netpeak

How Good Brands Make Bad Decisions on Amazon

If fashion brands aren’t standing out on Amazon, it’s often because they’re making the same strategic missteps — over and over again:

- Copy-pasting their DTC brand playbook onto Amazon without adapting to the platform’s UX and buyer psychology

- Recycling the same creative assets across all SKUs, ignoring each product’s role, intent and customer journey

- Prioritizing ad tweaks and bid optimizations over actual product messaging that resonates

- Measuring success solely by ROAS, while ignoring crucial brand-building metrics like branded search growth and repeat purchase rates

Fashion brands love to rely on aesthetics to do the heavy lifting. But on Amazon, pretty isn’t enough. It’s a performance-driven arena. If a listing doesn’t immediately answer why this product, why now and for whom, shoppers don’t just hesitate — they vanish.

Amazon doesn’t reward vibes. It rewards clarity, context and conversion. Brands that miss this end up fighting a losing battle — with great-looking listings nobody remembers.

The Shift That Separates Fashion Brands From Sellers

What Amazon fashion brands need isn’t just better execution — it’s a full strategic pivot.

The shift is from tactical moves to strategic differentiation — where every decision is anchored in relevance, not just reach. It starts by treating Amazon not as a discount outlet, but as a brand-building arena. Brands must build visual and verbal systems that deliver their promise instantly — in seconds, at thumbnail scale, before a shopper even blinks.

Campaigns can’t just chase clicks anymore. They have to carry brand storytelling — with measurable recall. Every Sponsored Brand ad, every Sponsored Product placement becomes a high-frequency brand exposure, layering recognition over time, driving not just transactions but preference.

Measurement has to level up, too. ROAS is a starting point — not the finish line. Real brand growth tracks metrics like branded search lift, repeat purchase rates, new-to-brand share, and branded vs. non-branded conversion deltas. These numbers show whether you’re just visible — or actually wanted.

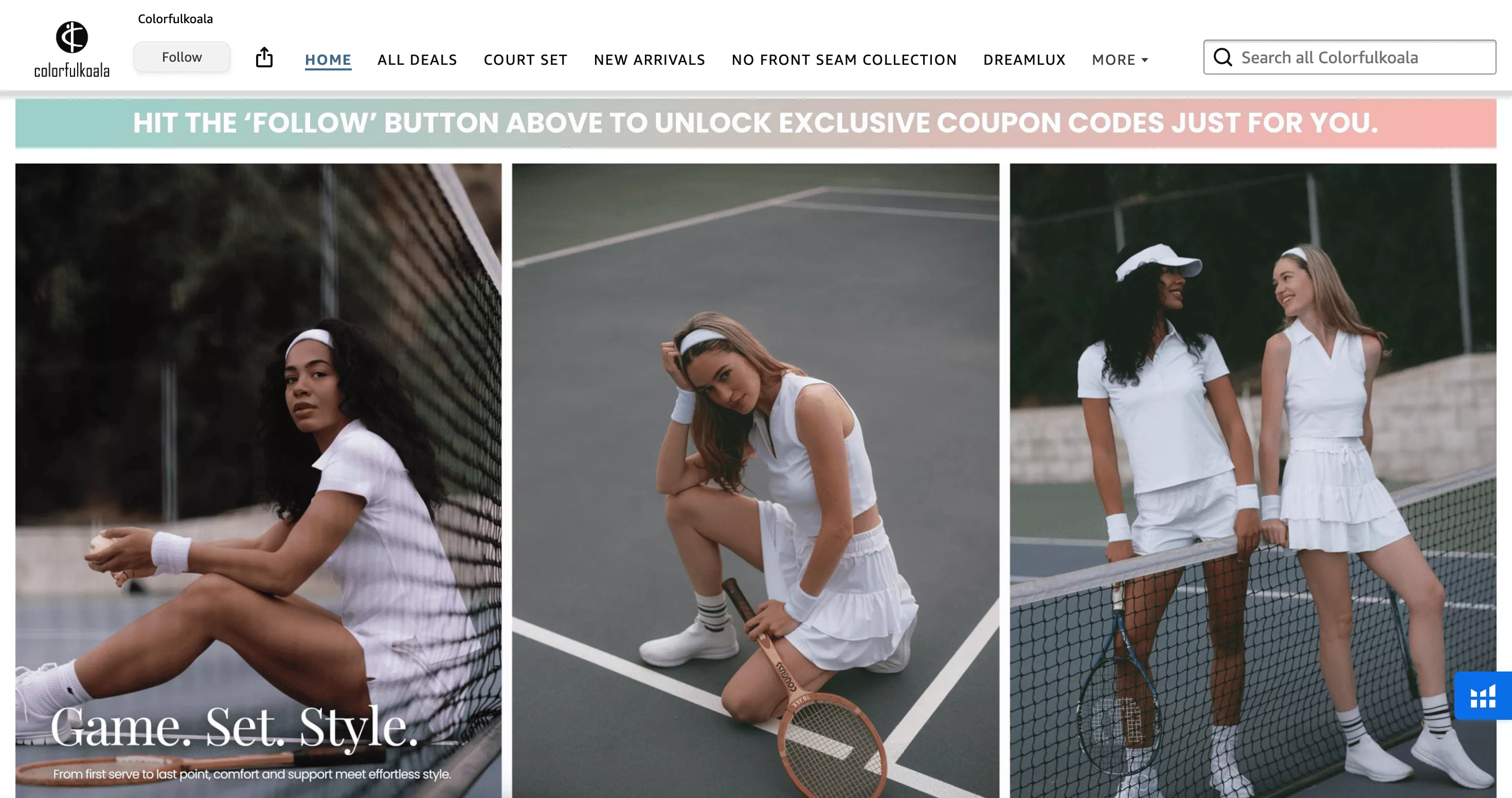

One brand getting it right? Colorfulkoala. This fast-growing athleisure brand didn’t copy-paste its DTC playbook onto Amazon. It built a marketplace-native identity: hero images that blend lifestyle with utility, EBC that focuses on fit confidence and product texture, and PPC campaigns structured around positioning, not just performance.

The result?

A loyal repeat customer base. Expanded ASIN coverage without cannibalization. Branded search share climbing quarter over quarter. Colorfulkoala proved that brand relevance, executed through platform-native strategy, can outpace both price wars and generic optimization.

Not louder.

Not cheaper.

Smarter.

Beyond Ads and Aesthetics: The Real Strategy for Amazon Fashion Brands

Brand differentiation on Amazon can’t be solved with isolated upgrades. It requires a tightly integrated strategy built around the platform’s behavioral mechanics, the emotional dynamics of fashion buying and the structural limitations of the marketplace.

Niche-Specific Considerations

Fashion is highly visual, emotionally driven and context-sensitive. Unlike functional categories, shoppers don’t search just for specs — they search for aesthetic fit. So we start with behavioral segmentation: who’s buying, what triggers their search, what doubts block conversion and what signals drive trust.

We consider:

- How the brand is positioned in its subcategory (price, aesthetic, product depth)

- Where differentiation naturally exists (design, fit, sustainability, cultural relevance)

- How shoppers behave on Amazon versus DTC or retail

- What the competition is doing — and where they’re weak (visual sameness, message fragmentation, overreliance on price)

Strategic-Level Solutions

For fashion brands on Amazon, a strategic solution is a structured system that turns brand identity into performance — through positioning, creative and campaigns built for how fashion is actually discovered and evaluated on the platform.

It starts with audience segmentation and demand mapping. Fashion shoppers act on use cases, aesthetics and fit — so we identify behavioral clusters (e.g., Gen Z streetwear buyers, performance-first activewear users) and build messaging around their specific triggers and doubts.

We then develop a visual identity system optimized for scroll behavior. Every image must answer: Does this fit me? Is this my style? Can I trust it? — in seconds. Hero images, video and A+ content are designed to align with decision stages, not just brand guidelines.

Next is campaign architecture by SKU role. High-LTV products get full-funnel support (SB, Video, DSP), while functional SKUs are bundled or promoted through high-volume terms. Campaigns follow how buyers move — not how brands organize catalogs.

We layer in retention mechanics — Brand Follow, post-purchase flows, seasonal sequencing — tied to repurchase behavior. In fashion, repeat rate is a margin unlock, not a bonus.

Finally, we close the loop.

Reviews, returns and conversion shifts aren’t just post-mortem metrics — they’re active inputs that shape ongoing creative and messaging updates. In fast-moving categories like fashion, performance isn’t powered by a “set it and forget it” strategy. It’s driven by continuous refinement — fast, responsive and unapologetically dynamic.

The brands that win? They treat every review, every return, every data point like a design critique — and they evolve in real time.

“Most fashion brands lose not because their products are worse — but because they’re indistinct. On Amazon, you don’t win with the most beautiful brand — you win with the clearest one. We treat each SKU like a campaign, each product line like a brand within a brand. That’s how you grow sustainably inside a marketplace built for comparison.”

Aliaksander Vlasenka,

Head of Marketplace Marketing Department at Netpeak

How to Actually Execute Brand Differentiation on Amazon (Step-by-Step)

Forget “optimize and pray.” Building a differentiated, defensible fashion brand on Amazon takes precision — and serious commitment. Here’s the no-shortcuts playbook:

1. Run a Strategic Brand Audit Across Your Amazon Footprint

Don’t just glance at your listings — dissect them.

Map your visibility gaps, pricing strategy, SKU distribution, conversion bottlenecks, review patterns and creative misfires. Evaluate your hero SKUs versus your long-tail support SKUs. Benchmark against both direct competitors and behavioral competitors (aka the brands stealing your shoppers).

Output: Category positioning map, SKU prioritization framework, content and creative gap matrix

2. Segment Demand Into Behavioral and Contextual Clusters

Stop targeting keywords. Start targeting intent.

Break down how your real customers search, evaluate and decide. What queries bring them in? What visuals seal the deal? What objections kill the vibe? Tie every insight back to use-case logic — think “workwear under $50,” not just “black blazer.” Align this intel to your SKUs’ strategic roles.

Output: Buyer cluster blueprints + keyword/creative intent model

3. Develop a Modular Brand Identity System Built for Amazon

Consistency wins. Chaos loses.

Build a flexible but coherent visual identity system:

- Mobile-first hero images that instantly answer “fit,” “feel” and “trust.”

- A+ templates designed for product roles (premium, functional, seasonal).

- A storefront organized by customer logic, not catalog chaos.

Output: Asset playbook with conversion-tested templates + cross-SKU creative alignment

4. Engineer Campaign Infrastructure by Journey Stage and SKU Type

Generic ads are for generic brands.

Architect your Sponsored Products, Sponsored Brands and Sponsored Video campaigns with journey stage segmentation baked in.

Prospect with DSP only after your branded and consideration layers are airtight. Pull external traffic sources (influencers, paid social, Google) into your funnel with Amazon Attribution and Brand Referral Bonuses.

Output: Funnel-aware campaign map + budget model tied to SKU lifecycle and margin

5. Activate Brand-Building Levers Inside Amazon’s Ecosystem

Use every tool Amazon hands you — the right way:

- Build Brand Follow audiences

- Launch high-velocity ASIN bundles

- Trigger Customer Engagement campaigns tied to lifecycle events

- Refresh listings using real review insights

- Generate UGC-style creatives to reinforce authenticity

Output: Retention stack with built-in reactivation, cross-sell, and loyalty triggers

6. Build Performance Feedback Systems with Creative + Media Signals

Creative that doesn’t evolve dies fast.

Set up systems that track:

- Conversion rate shifts

- Search term evolution

- Review content themes

- Customer Q&A patterns

Use this intel to drive constant creative refresh cycles — not just “when you have time.” Monitor creative fatigue and content velocity as leading indicators, not “nice to knows.”

Output: Creative-performance dashboard + optimization backlog tied to business impact, not aesthetics

7. Govern the System Through LTV-First Metrics

ROAS tells you if you made a sale.

LTV metrics tell you if you’re building a real brand.

Track:

- Branded search lift

- Repeat purchase rate

- Click-to-repeat window

- Product-level LTV:CAC ratios

- Contribution margin per SKU cluster

Monitor long-term cracks before they become chasms: declining non-branded conversion rates, shrinking branded-to-non-branded search ratios, etc.

Output: Executive dashboard built for long-term defensibility, not short-term dopamine hits

Timelines:

- Initial setup: 6–8 weeks

- Creative + campaign deployment: 2–4 weeks rolling

- Feedback loops + optimization: bi-weekly review, monthly asset refresh

Key success metrics:

- +25–40% branded search volume in 90 days

- +3–7pp conversion rate on prioritized SKUs

- Repeat purchase rate >25% within 90–120 days

- ROAS stability with scaling spend (3.5×–5× target)

- LTV:CAC above 3:1 sustained over two quarters

- Creative-to-live velocity under 14 days per test cycle

How Smart Fashion Brands Werk the Amazon Runway

- Design for scroll, not style.

Most brands design hero images and A+ content like website banners — clean, minimal, on-brand. But Amazon is a high-speed scroll environment. Winning creatives don’t just look good — they interrupt patterns, resolve doubts and build trust instantly. Add contrast, zoom into fabric texture, overlay fit callouts — especially in crowded fashion categories where “polished” often equals “invisible.”

- Use customer reviews to drive creative strategy.

Your review section is not just a trust signal — it’s a feedback loop. Extract themes from top-rated and most critical reviews to identify conversion barriers (e.g., sizing confusion, color mismatch, return friction). Use this insight to update your bullets, image overlays and ad copy. Done consistently, this reduces returns and increases post-click conversion.

- Break out of the attribution tunnel.

Too many brands optimize ads in isolation. But attribution on Amazon is limited — and lagging. Use branded search volume and new-to-brand conversion as leading indicators of whether your campaigns are building preference, not just clicks. High-performing brands track how non-branded search converts into branded interest over time.

- Refresh creative on a cycle — even when it’s working.

Creative fatigue hits faster in fashion. Even high-performing assets begin to lose impact after 6–8 weeks due to frequency, seasonal shifts or trend changes. Build a creative velocity model: 2–3 new hero image variations monthly for top SKUs, A+ refresh every quarter, new video every 60 days. It’s not waste — it’s compounding performance.

- Master category context.

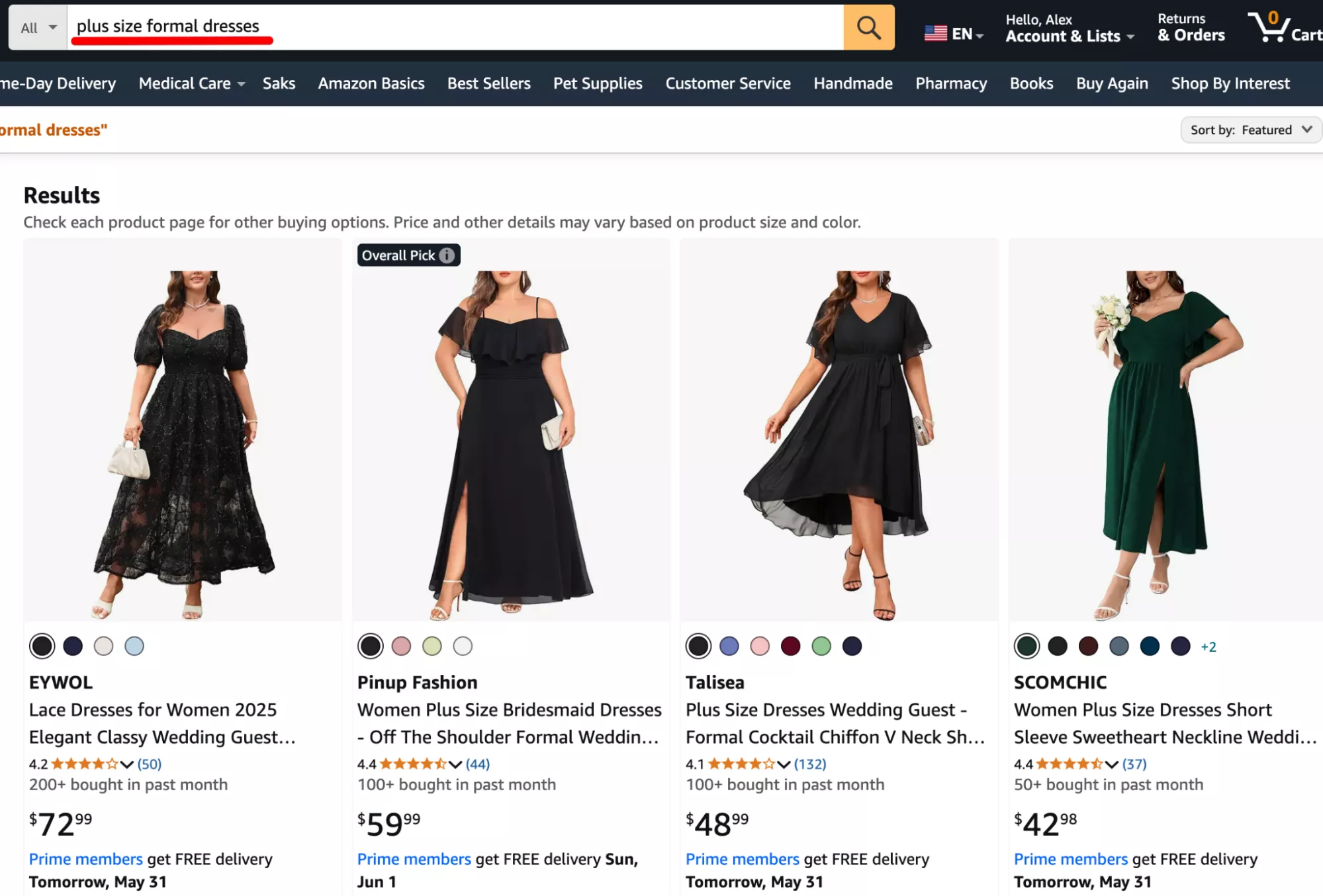

Many fashion brands fail because they ignore the Amazon-native expectations of their subcategory. Athleisure customers expect fit overlays and mobility demos. Plus-size shoppers prioritize sizing trust and real-body visuals. Streetwear buyers respond to scarcity and aesthetic edge. Don’t just build great creative — build category-native creative.

Differentiate or Disappear: Your Fashion Brand’s Amazon Reality Check

No brand wins a price war.

Iconic brands don’t race to the bottom — they rise above the noise. On Amazon, that means building emotional relevance, owning your positioning and playing a long game built on memory, not markdowns.

The brands that survive aren’t the ones that chase clicks or panic when competition spikes.

They’re the ones that make customers feel something — and keep them coming back for more.

In a marketplace that erases sameness, differentiation isn’t optional. It’s survival.

Need help with your strategy? Netpeak can help.

Related Articles

How to Set Up Consent Mode in GA4 on Your Website with Google Tag Manager

Let's explore how to properly integrate consent mode in GA4, configure it for effective data collection, and at the same time comply with GDPR and other legal regulations

Display Advertising Effectiveness Analysis: A Comprehensive Approach to Measuring Its Impact

In this article, I will explain why you shouldn’t underestimate display advertising and how to analyze its impact using Google Analytics 4

Generative Engine Optimization: What Businesses Get From Ranking in SearchGPT

Companies that master SearchGPT SEO and generative engine optimization will capture high-intent traffic from users seeking direct, authoritative answers