All About Market Research, and Why Everyone Needs It

Research is the foundation of all marketing activities. Marketers use the data obtained from research to define target audiences and create successful strategies and advertising campaigns. It also allows businesses to understand the factors that influence customer behavior, making research an essential process.

In this article, I will tell you:

- What is market research?

- Who needs it?

- What can it tell you?

- Types of market research

- How to perform market research?

- Tools for conducting market research

What is market research?

Market research is the process of gathering information about the target audience and the reference market using various methodologies and digital tools. It has several uses:

- Creating and launching new products.

- Assessing the company’s health indicators.

- Understanding the perception and evaluating the effectiveness of brand communication.

- Researching the specifics of the market, such as characteristics, competition, and trends.

- Entering new markets.

Companies are increasingly investing in market research. According to GlobalNewswire, the market research services market will grow from $75 billion in 2021 to $90 billion in 2025.

Who needs market research?

The results of market research will determine several key decisions, for example, the current design and effective market positioning of a company. Let’s discuss who needs it.

- Brands. Market research helps brands identify competitive advantages through objective ideas and recommendations for promotional strategies based on consumer insights.

- Sellers of goods. By identifying potential product issues, market research helps sellers develop a better product and an improved sales plan that is more likely to resonate with target customers.

- Service companies. It provides valuable information about customer needs and preferences, enabling companies to improve their services.

- B2B companies. Market research identifies the current needs of the target audience. According to Accenture, 80% of B2B customers switch vendors at least every two years due to unmet expectations.

What sorts of insights can market research provide?

Here’s a list of the types of data that quality market research can provide.

Target audience portrait

The research will identify the customers most likely to benefit from the product. This includes:

- sociodemographic characteristics of customers, such as age, gender, location, and ethnicity;

- socio-economic information, such as their education, income, and employment status.

This data will help businesses further segment their audience and provide personalized offers to different subgroups of customers.

Case study: Sprintzeal conducted a marketing study of the target audience for Nike, and they came to the following conclusions.

- The target audience includes people involved in sports across different age groups and geographic regions.

- The target audience includes athletes who strive for high performance, consumers who value comfort and style, and socially conscious people who share the values of the Nike brand.

- Inspirational marketing campaigns and athlete support encourage customers to be highly loyal to the brand.

- Social media platforms are key channels for interacting with consumers.

Behavioral characteristics of customers

The first step in running a successful business is to know your customers. Market research helps you understand the motivations, needs, and price sensitivities of current and potential customers.

For example, data may show that older customers are more likely to buy a product based on price, while younger customers are motivated by the company’s values. Based on this information, a brand can adjust its marketing strategy.

Market research tools can also help companies understand what customers buy and when, why, and how they buy. For example, if customers are most likely to shop for a certain product between 17:00 and 20:00, it makes sense to send promotional offers by email at 16:45.

Case study: Start.io conducted a study of Starbucks’s customer behavior and preferences, and several conclusions were reached.

- The chain’s loyal customers often develop a habit of visiting the store regularly. One customer noted that he shops at Starbucks every day and spends more than $2,000 a year.

- Starbucks motivates this customer behavior with a rewards program. As of 2019, it had 17 million subscribers in the United States, making it the largest rewards program in the restaurant industry.

- Starbucks stores are typically located in cities and suburbs, making them ideal places to meet others or get work done.

- Pickup and order through the drive-thru is the most popular way to shop at Starbucks, accounting for up to 80% of sales.

Industry trends

Analyzing market trends is one way to gain a competitive advantage. It involves studying data to identify patterns and consumer trends in a particular market.

Companies can then use this information to make informed decisions about strategies and promotions.

For example, market research may show that information products should consider actively using artificial intelligence in the market, and companies can then implement it in their own processes.

It is also worth analyzing market characteristics: the type of competition, seasonality, specific market structure (with dealers or buyer-sellers), whether someone has a monopoly, etc.

Information on competitors

Competitive analysis is the process of gathering data on competitors’ products, sales, and marketing strategies. Companies can use this data to determine their own strengths and weaknesses and to identify potential opportunities for growth.

The details included in competitive analysis depend largely on the company’s goals and industry. For example, the owner of an online pet store will want to know what products competitors are selling. Whereas, a SaaS company will want to analyze competitors’ features and pricing pages.

Here are some ways to identify direct competitors.

- Market research. Ask the sales team which competitors are often mentioned when people talk to them.

- Customer feedback. Once customers have chosen your product, ask them who else they considered.

- Social media and online communities. Many look for recommendations on social media or in forums like Reddit and Quora. Search customer conversations to find potential competitors.

- Competitive analysis tools such as Market Explorer will give you a general idea of the industry’s main players.

Case study: Airbnb conducted competitive research with the goal of entering the Israeli market. They used SimilarWeb’s Industry Analysis module and researched local news, social media, and search engine trends.

Based on their findings, they identified the strongest competitors and analyzed each one separately.

The result: it helped them create an effective marketing strategy.

Market demand

To turn clicks into conversions, it’s crucial to have a deeper understanding of people’s motivations at the beginning of the customer journey. It is worth analyzing market demand, which is determined by several factors:

- The existence of an unmet consumer need in the market and whether the company can meet it.

- The number of people actively searching for a similar product.

- The amount they are willing to pay for it.

- The accessibility of the product to consumers.

Case study: LEGO studied the market to understand whether there was a demand among girls, as the company had focused on boys for many years.

Experts conducted a four-year study of 3,500 girls and their mothers to understand children’s play habits.

The result: LEGO released a new line of toys based on the Friends franchise to encourage girls to buy them.

Pricing strategy

Pricing is critical. According to Bain & Company, price is the single most important driver of profitability. Market research can help you understand how much customers are willing to pay for a product or service and determine the optimal price. It should be low enough for customers to be willing to part with their money but high enough to ensure sufficient profit for the business.

Small changes in price can have a big impact. According to a McKinsey study, if companies on the Global 1,200 list increase their prices by just 1%, their profits will increase by 11%.

B2B market trends

B2B market research focuses on the industrial consumer, who acts as an intermediary between the manufacturer and the end user. Decision makers on behalf of companies are the subjects of research.

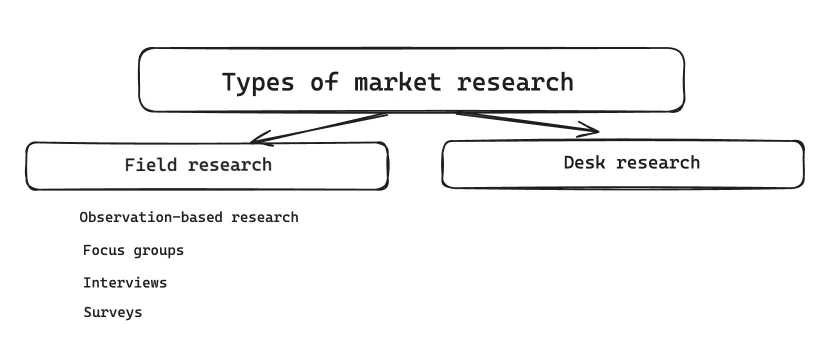

Types of market research

Market research is based on two kinds of information:

- Primary information is collected from consumers through field research, such as surveys and observations.

- Secondary information is gathered through desk research.

Field research

Field research is the main source of primary information. It can be conducted in-house by the company’s marketing specialists or outsourced to an external agency or consulting firm.

Although outsourcing field research may seem more expensive, it is more profitable in the long run. External market researchers tend to have more experience and well-established processes. Importantly, they have a fresh perspective that helps avoid bias and impartiality.

Several methods exist for field research. Your choice will depend on your objectives, budget, time constraints, etc.

Surveys

These are conducted online, offline, via SMS, etc. They are relatively inexpensive because participants fill out the questionnaires themselves, and much of the process can be automated. According to Statista, nearly 90% of market researchers regularly use online surveys.

Here are some tips for conducting surveys.

- Prepare well-written research questions to get the right information from each participant.

- Begin the research with a clearly defined goal. This will allow you to focus your time and energy in a specific direction.

- Keep the survey short and concise to ensure a high response rate.

- Eliminate any questions that are even slightly redundant.

- Make sure the questions are objective and do not require a specific answer.

Examples of possible questions.

- What brands of chocolate (product names) do you know?

- How often do you buy these brands? (Provide answer options.)

- What associations do you have with the brand?

- Name the sources of information you use to monitor the news.

Interviews

Interviews are more labor-intensive than surveys. They require time and money, as you will have to hire a qualified interviewer and set up a venue, phone line, or video link. Personal interviews are based not only on respondents’ answers but also on the interviewer’s observations.

Here are some tips for conducting interviews.

- Choose the most convenient way to communicate, whether in person, online, or by phone.

- Each interview should be approached as a conversation; use open-ended questions that allow the respondent to speak freely.

- Define the sample. A minimum of 5-10 participants per segment is needed to obtain sufficient data from in-depth interviews. The total sample size will depend on the purpose of the research, the diversity of the segments you want to represent, the market, and the budget.

- Take a few minutes to make small talk with the respondents and make them feel comfortable. Many people tend to feel uncomfortable in the role of respondent. Build rapport by asking them about their life, work, and hobbies. This will help them be more honest and open in the following stages, where depth of response is extremely important.

- Be flexible. Having a list of questions will help keep the interview on track. However, it is important to be prepared to ask additional questions for clarification or explanation. Respondents have different communication styles. Some will feel comfortable talking a lot about a topic, while others will need encouragement or prompting.

Focus groups

This is an interview with several participants at the same time, usually in the form of a discussion moderated by a researcher. A focus group is necessary to identify insights in the course of group dynamics.

Interaction among the participants can reveal more unexpected findings but can also cause the conversation to deviate from the topic. The moderator must prevent this by skillfully steering the discussion in the right direction.

Observation-based research

Observational research is a method of collecting data about consumers by observing their behavior under natural or controlled conditions. It gathers information about how consumers interact with products, packaging, and advertising in real-life situations. Observational research is often used in conjunction with surveys and focus groups.

For example, for a company that sells smartphones, researchers will want to observe how customers use smartphones in everyday life. They may investigate the most popular features and applications and how consumers hold and interact with their phones.

This information is then used to make decisions about product design and marketing strategies.

Another example of observational research is analyzing a website’s or advertising materials’ heat map. In this case, researchers will use eye movements to track which areas of an ad or website users pay the most attention to.

Desk research

Desk research involves the collection of secondary information or previously published data on a topic of interest to the company. It helps lay the foundation for a research project and provides a stronger knowledge base for testing hypotheses.

There are numerous sources of secondary information.

- Industry articles. For example, a real estate market overview from Forbes, global retail trends from Think with Google, price trends in Europe from Trending Economies, or a sports nutrition market overview from MarketResearch.

- Market research reports. Secondary research from professional research agencies has reliable data collection and analysis methods. For example, ReportLinker’s cereal market analysis or PWC’s pre-purchase consumer experience survey.

- Government reports and studies. Open source data, such as the quarterly results from the National Bank of Canada.

- Trade or industry associations publish-secondary data collected over time. For example, holiday 2023 shopper trends from the American Marketing Association.

- Government statistical agencies. Official statistics for the country you are interested in. For example, the consumer price index in January 2024 from the Bureau of Labor Statistics.

How to conduct market research

Here are step-by-step instructions on how to find the information you need.

Step 1: Set goals

This is the most important stage of the research. The rest of the budget and methodology will depend on the objectives.

For example, a study on entering a new market requires analyzing the potential market and potential consumers, whereas a pricing study requires analyzing competitors’ prices.

Step 2: Develop a research methodology and plan

At this stage, a document is created with all the steps that need to be taken to achieve the research goal:

- The first step is to analyze the market using secondary methods.

- The second step is to interview consumers about their behavior, preferences, etc.

For example, for competitor research, you may want to conduct:

- Desk research of open sources;

- Mystery shopping is when a company representative secretly calls or visits competitors and examines their assortment, service, and prices.

Step 3: Data collection

At this stage, implement the research methodology you developed earlier.

- If you plan to conduct a survey, write a list of questions, find a convenient survey tool, create it, and send it to your target audience via email or social media. You can also conduct a live survey.

- If you want to do desk research on a particular topic, be sure to study all the open sources you can find.

- If you need to do mystery shopping, call your competitors and find out their rates. For example, for a real estate company, you will want to determine the commission they charge for the service.

Step 4: Analyze the information

This step involves aggregating the collected data and further identifying patterns or differences in consumer behavior or other objects of analysis.

Once you have conducted a secondary research and collected enough information on the topic, it is time to analyze trends and identify what they can affect.

Step 5: Conclusions and recommendations

At this stage, think about the trends that you have found and how they can be used to improve marketing activities. Also, use the findings of your research to come up with ideas for further action.

How to find data for research

It is important to automate your work. Not only will automation reduce errors, but it will also produce faster results.

Survey tools

- SurveyMonkey allows you to create a survey and send it to your audience. It has a free version, with paid monthly plans starting at $25.

- Google Forms is a free basic tool available to anyone.

- TypeForm. If you need a simple form or survey, TypeForm will do the trick. It works especially well on mobile devices. Prices start at $21 per month and must simultaneously be paid for the entire year.

- Qualaroo. This is perfect for getting quick feedback from website visitors. It is free for the first 50 responses.

Tools to study market trends

- Google Trends. This free tool will tell you what people are searching for online. It also shows changes in the volume of searches for important topics over time.

- Statista. If you are looking for statistics and trends, this is a great free service to start with.

- IBISWorld. Regularly updated reports provide insight into the current state of industries, market outlook, and competitive environment. You must pay for a subscription to use it, but you can download free reports to test the tool.

Tips and best practices

- Set clear goals. This should be done before you start researching to determine the budget and the most effective methods.

- Use a variety of research methods to get comprehensive information: surveys, focus groups, interviews, or secondary methods such as data mining. Each method has its advantages and will provide different perspectives on the market.

- Use multiple data sources to enrich your research and validate your findings: customer feedback, sales data, industry reports, competitive intelligence, etc.

- Be flexible. After receiving initial feedback, be prepared to adjust the methodology and questions. Regularly review and refine the research plan to ensure it is relevant to the goals and needs of the business.

- Focus on actionable conclusions. Provide actionable recommendations for marketing strategy, product development, and business growth.

Read more about online advertising in our blog:

- Pay-Per-Click Advertising Model: What It Is and Why You Need It

- What Is Email Marketing? A Complete Guide

- What Is SEO, and Why Do You Need It?

Common market research mistakes

Biases

Companies often think they know their target audience, but the reality can be quite different.

Case study: Historically speaking, American fast-food chains have often failed to resonate in the Vietnamese market. In 2012, Burger King’s ambitious plans to enter the market failed. The same thing happened in 2014 with McDonald’s, which planned to open 100 stores within 10 years but stopped at 17 with no plans for further expansion.

This was due to a lack of consideration for the cultural characteristics of the country’s residents. For instance, Vietnamese consumers love chicken and sharing meals with loved ones. Therefore, they prefer local street vendors.

By 2018, visits to Burger King and McDonald’s in the country had decreased by 31%, while local food stalls continued to flourish.

Underestimating the work

Companies often underestimate the amount of work required to conduct market research. Bringing in an experienced partner saves time and resources, ensures reliable research methods are used, and provides an unbiased assessment.

The bottom line

- Market research is a key step in creating a successful business strategy. It allows you to gather information about your target audience and market.

- Brands, B2B companies, product vendors, and service companies all need market research.

- Market research provides insights into the target audience profile, customer behavior, industry trends, key competitors, demand, and appropriate pricing.

- Market research can be divided into field research and desk research. Field research includes surveys, interviews, focus groups, and observational research. Desk research is the basis for field research and provides the context for marketing analysis.

- The market research process involves five stages: setting goals, developing a methodology, collecting data, analyzing information, and drawing conclusions.

- Useful survey tools include SurveyMonkey, Google Forms, TypeForm, and Qualaroo.

- Google Trends, Statista, and IBISWorld are popular tools for researching market trends.

Related Articles

Firebase Dynamic Links Is Shutting Down — Here’s How to Preserve Functionality and Retain Users

How to prepare for the shutdown of Firebase Dynamic Links and preserve deep linking, analytics, and UTM tags using App Links, Universal Links, or third-party services

How to Set Up Consent Mode in GA4 on Your Website with Google Tag Manager

Let's explore how to properly integrate consent mode in GA4, configure it for effective data collection, and at the same time comply with GDPR and other legal regulations

Display Advertising Effectiveness Analysis: A Comprehensive Approach to Measuring Its Impact

In this article, I will explain why you shouldn’t underestimate display advertising and how to analyze its impact using Google Analytics 4