Case Study: Using Market Analysis to Identify Key Points for Business Development in the Czech Republic

At Netpeak, we are experienced in helping our partners and clients penetrate new markets. However, it's one thing when a business decides to scale up after successfully establishing itself in a single country. It is another when it comes to a startup that is only just venturing into an unfamiliar country. In either case, the first step is to perform a market analysis. We have a clear algorithm for such an analysis, and this is what our case study is about.

Region: Czech Republic.

Service: Marketing analysis.

The Client

CRAFTER (working name) is a startup that provides home improvement services on the Czech market. The startup team includes Ukrainian management and craftsmen from Ukraine in the Czech Republic. The main goal of the company is to connect customers of quality home improvement services with Ukrainian craftsmen looking for an additional source of income.

Goals of the market analysis

The client contacted Netpeak for Czech market research services. The CRAFTER team wanted to understand the potential and competitive saturation of the market and identify the target audience.

We worked to find answers to the following questions:

- What is the market potential (i.e. the market size)?

- What factors influence the market?

- Who are the potential consumers?

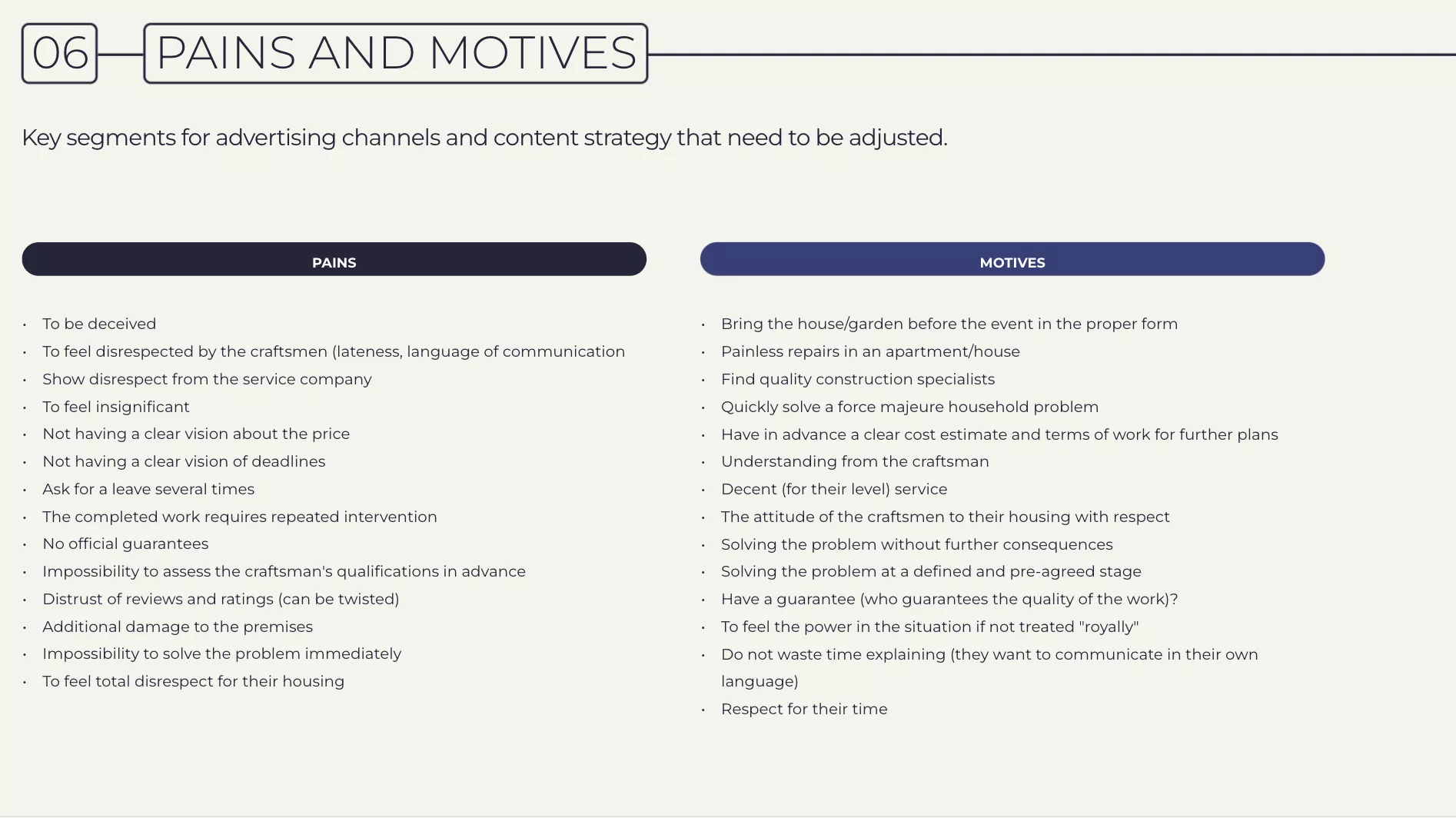

- What are the potential consumer's pain points and drivers?

- Who are the competitors?

- What monetization methods are the competitors using?

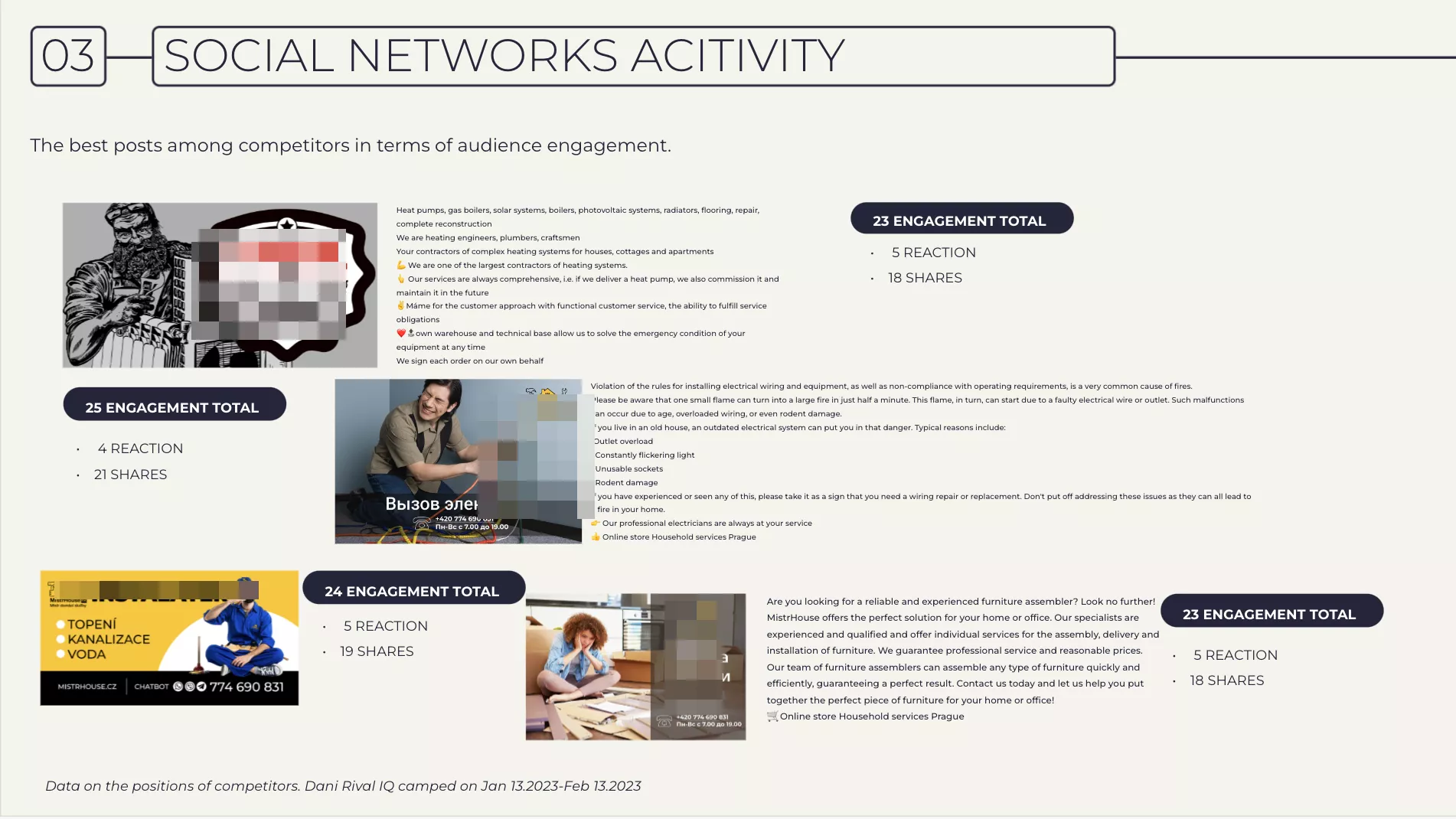

- What channels and messages are the competitors using for promotion?

- What promotional channels should we use?

We had to work in a fairly broad niche with a large number of players. In addition, it turned out that Czechs are quite reserved when it comes to communication, and we had to use certain creative approaches to communicate with the target audience. This was an interesting challenge for the team.

Solution

To find answers to all these questions, the team used:

- Desk research

- Interviews

- Communication with experts

We first identified insights through qualitative research, such as interviews and communication with experts. Then the team tested the insights/hypotheses through desk research, searching for statistical data to confirm or reject the hypothesis.

For an organized approach, we divided the analysis into broad blocks. Each block complements the next and informs the next steps in the research.

1. General market analysis

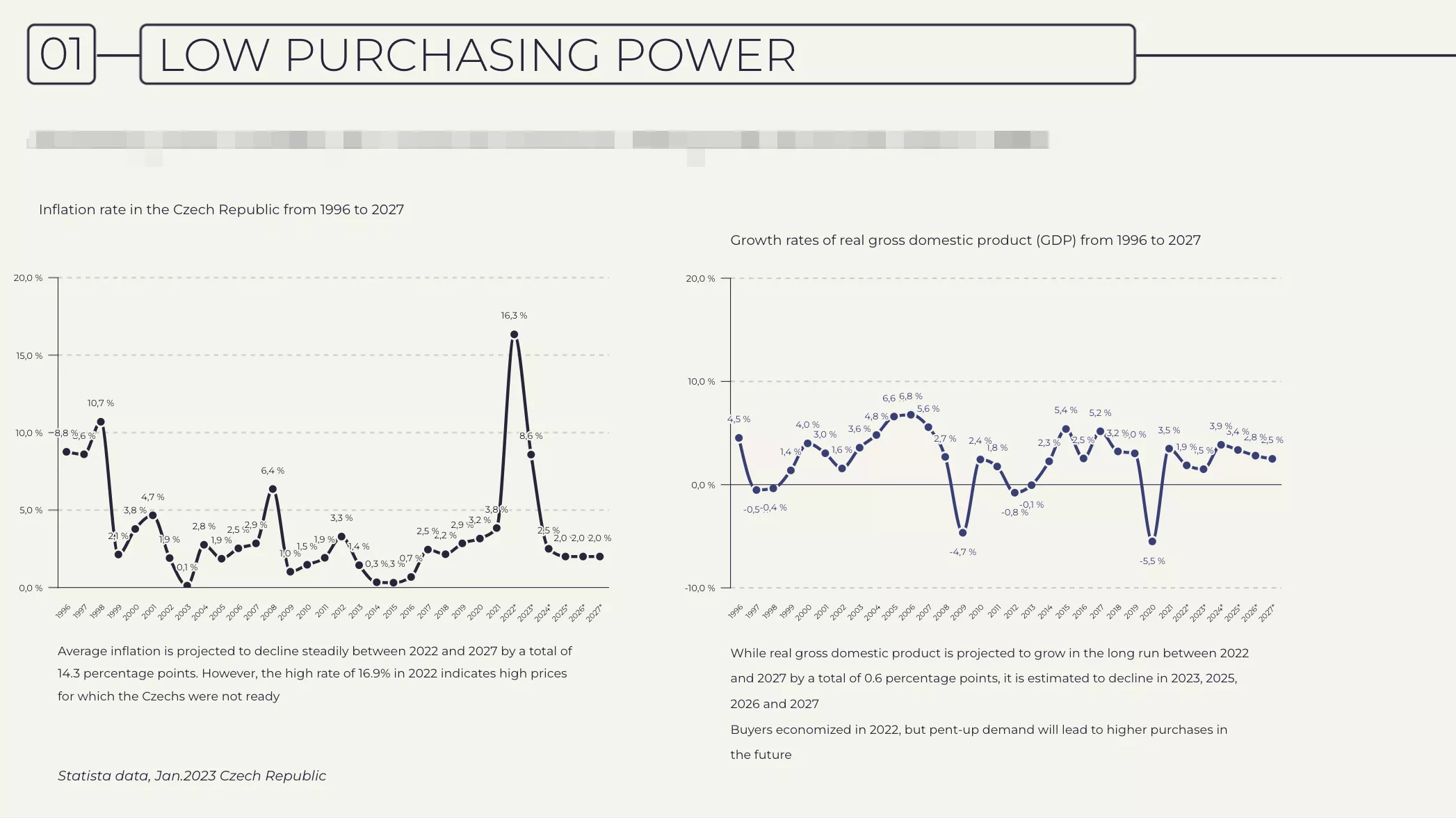

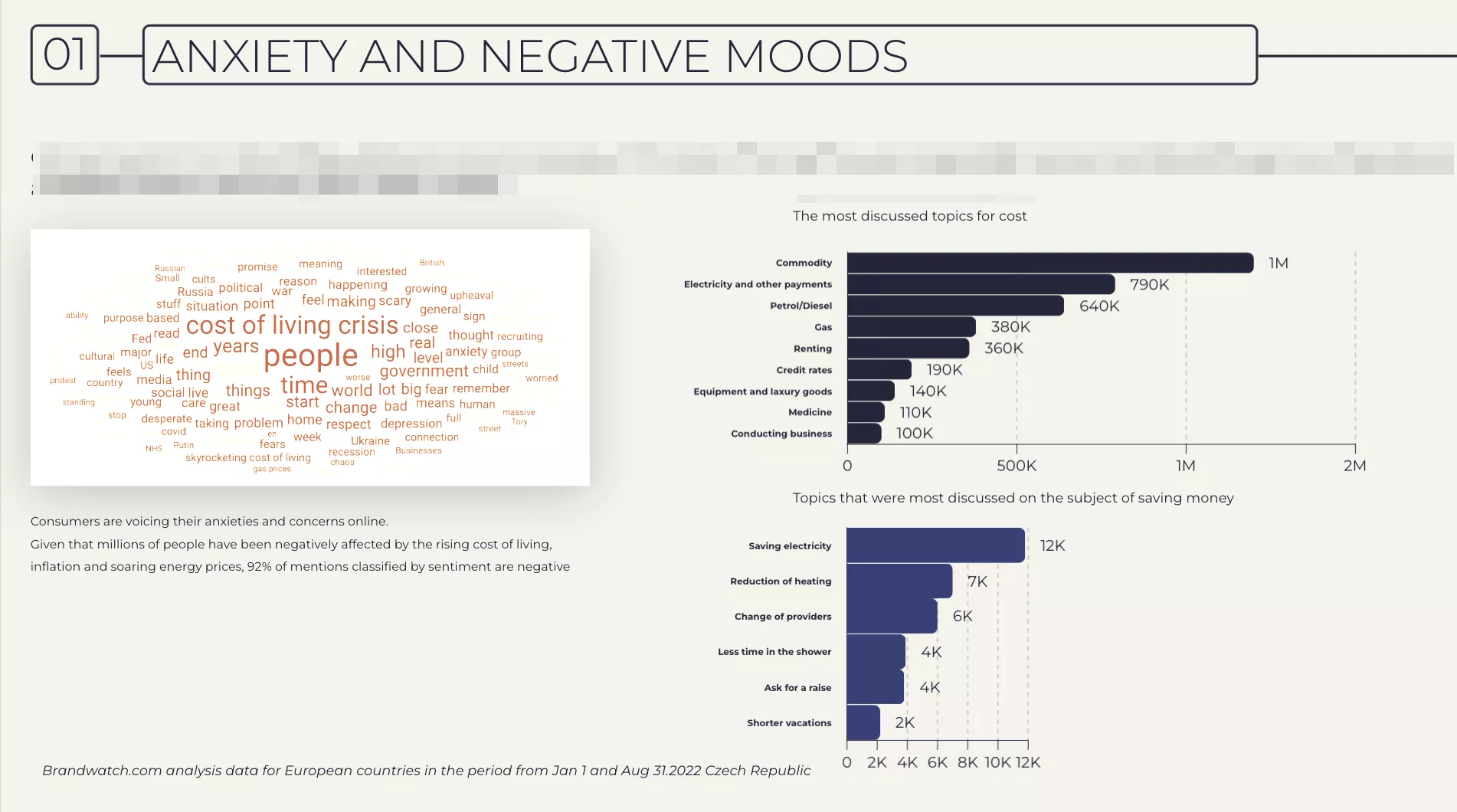

The general market analysis focused on economic and social factors affecting the startup.

The analysis showed that "inflation and negative consumer sentiments have forced the Czech population to look for ways to save money on home services."

This hypothesis was confirmed by:

- Statistical sources.

- Brandwatch report, which is an analysis of conversations and user requests on social media.

- Experts who say, "Czechs are now saving money."

2. Determining the size of the target market

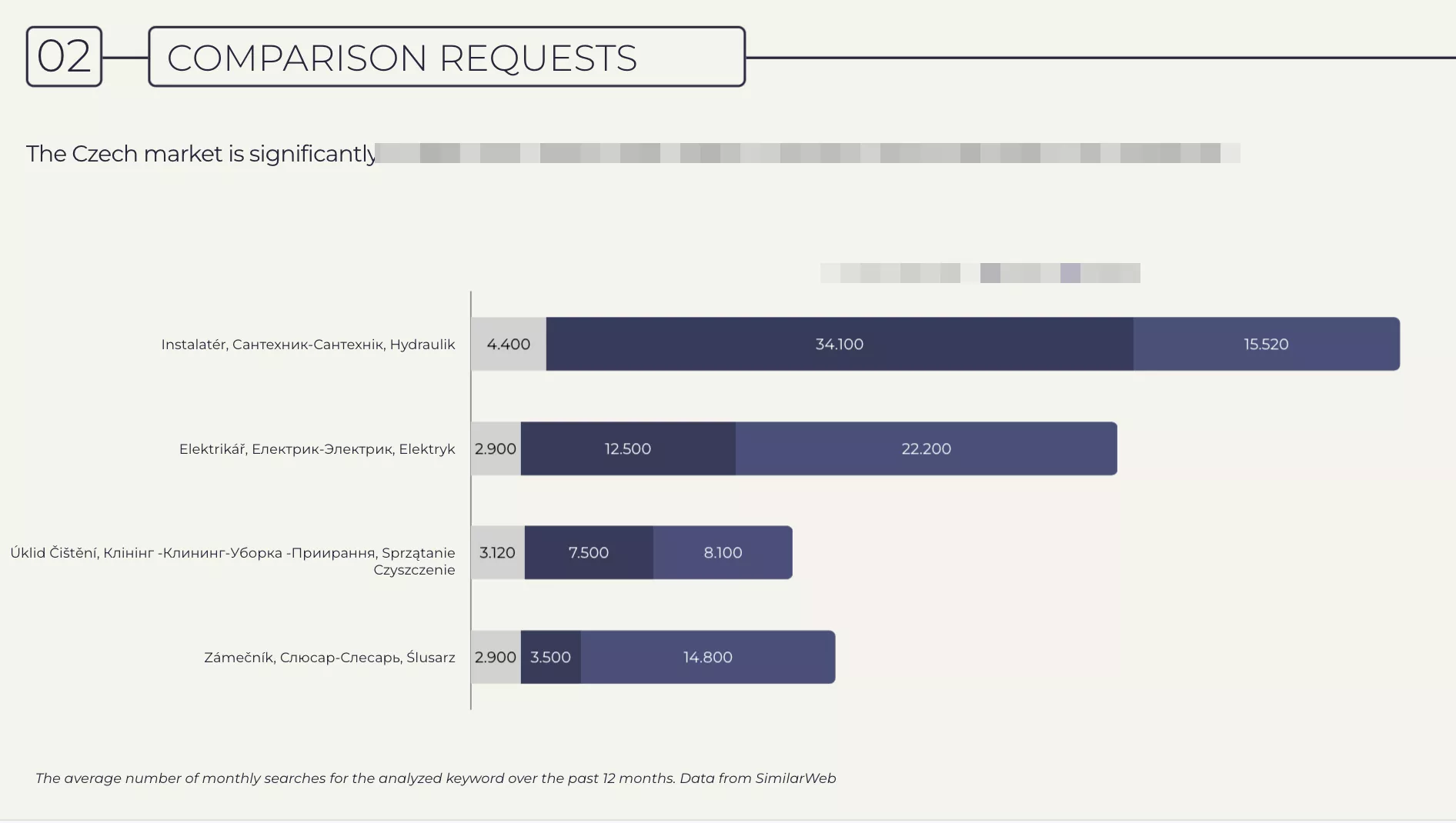

To understand the size of the target market, we focused on the following categories:

- The total number of Internet users in the Czech Republic — the total addressable market (TAM).

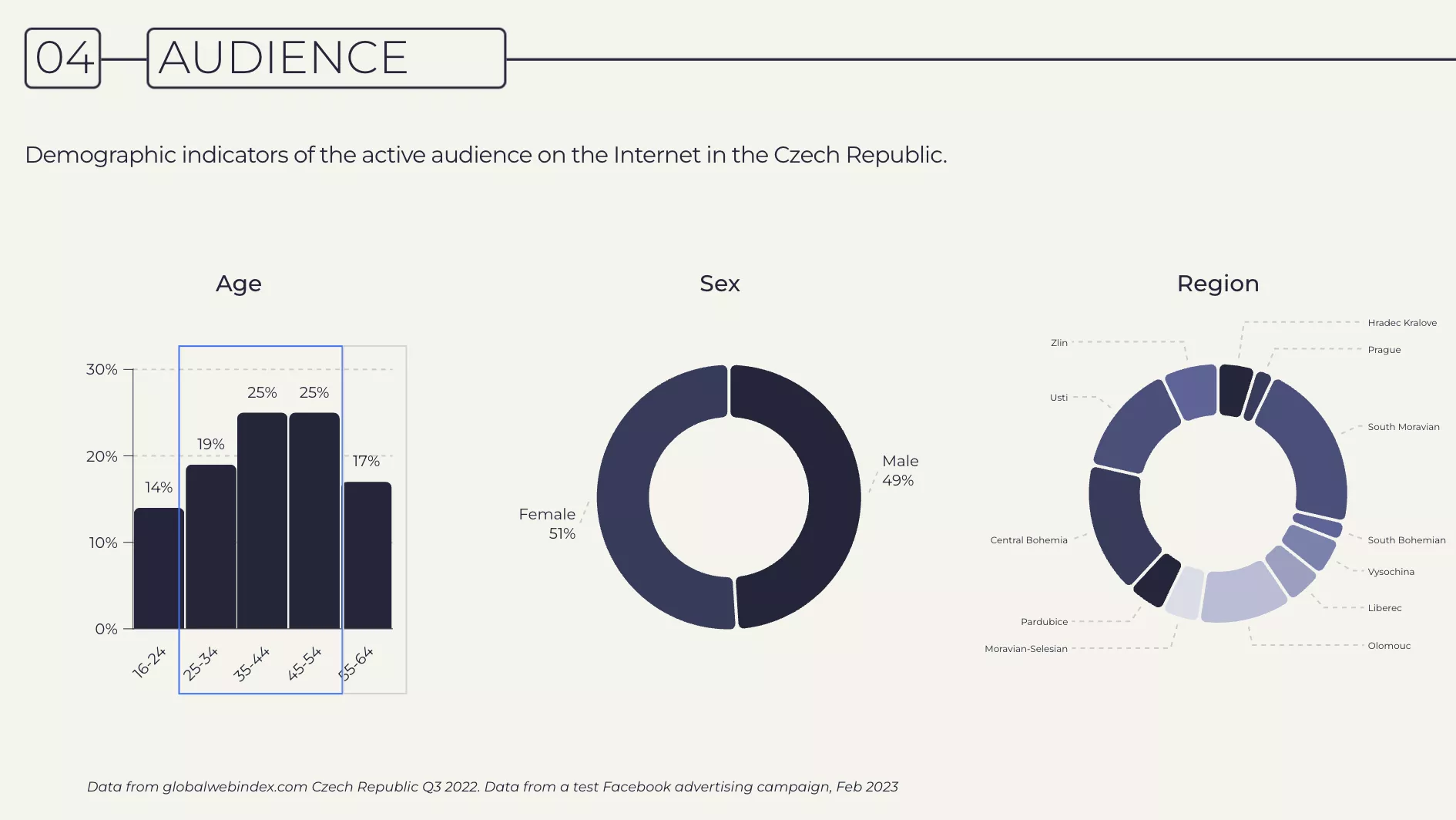

- The number of users aged 24-64, i.e. active customers of online services — the serviceable addressable market (SAM).

- The number of women in this category on the Internet, as they are the main customers of targeted services — the target market.

We also determined the number of key queries in each category and compared them to queries in Ukraine and Poland. In terms of user behavior on the Internet, these are the closest markets that are similar for this service. In particular, the analysis showed that the size of the target market is adequate within the Czech Republic, but small compared to similar countries. Therefore, CRAFTER should consider expansion in the future.

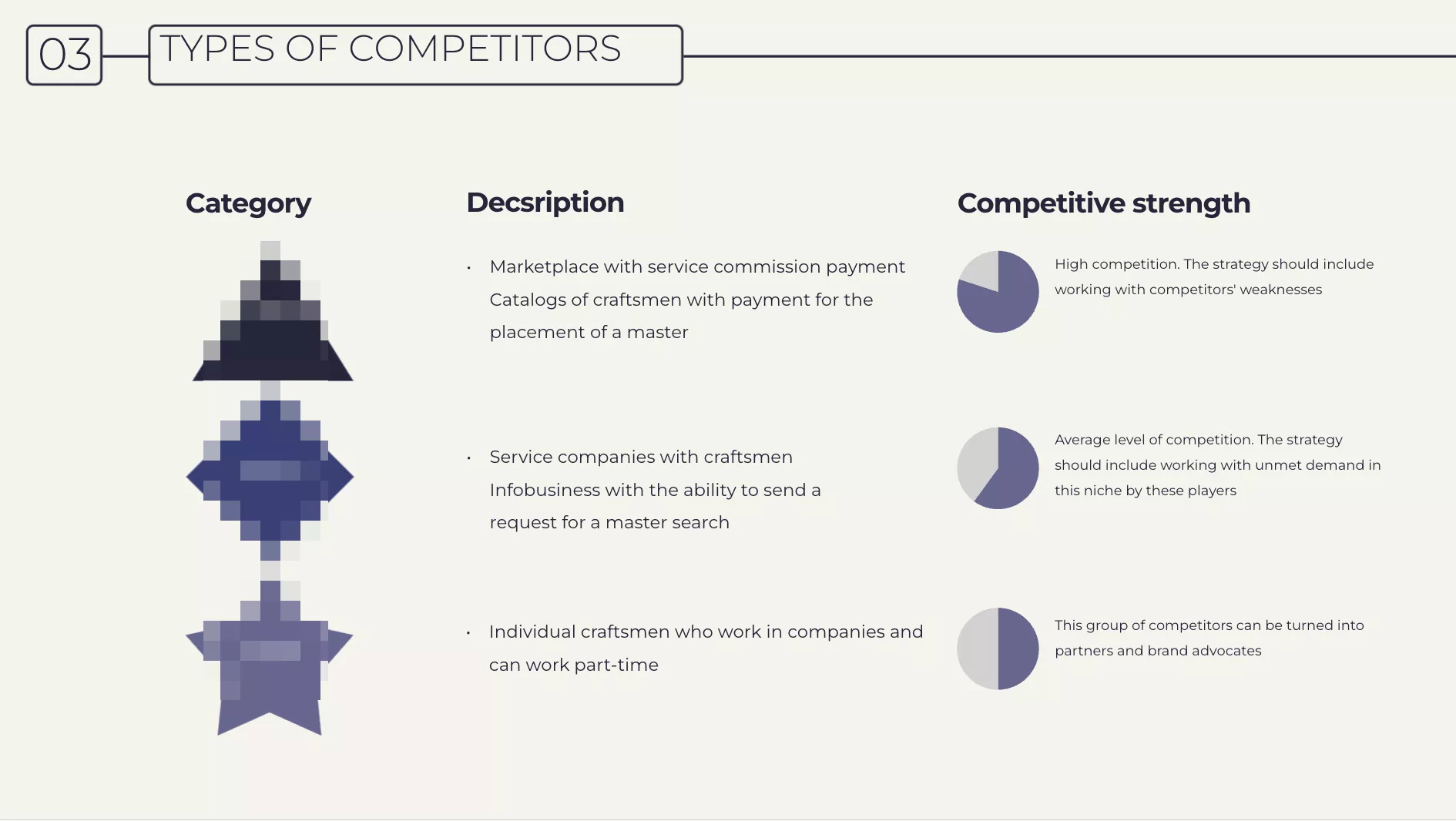

3. Competitor analysis

The competitor research was conducted in two stages. The first stage involved identifying competitor groups.

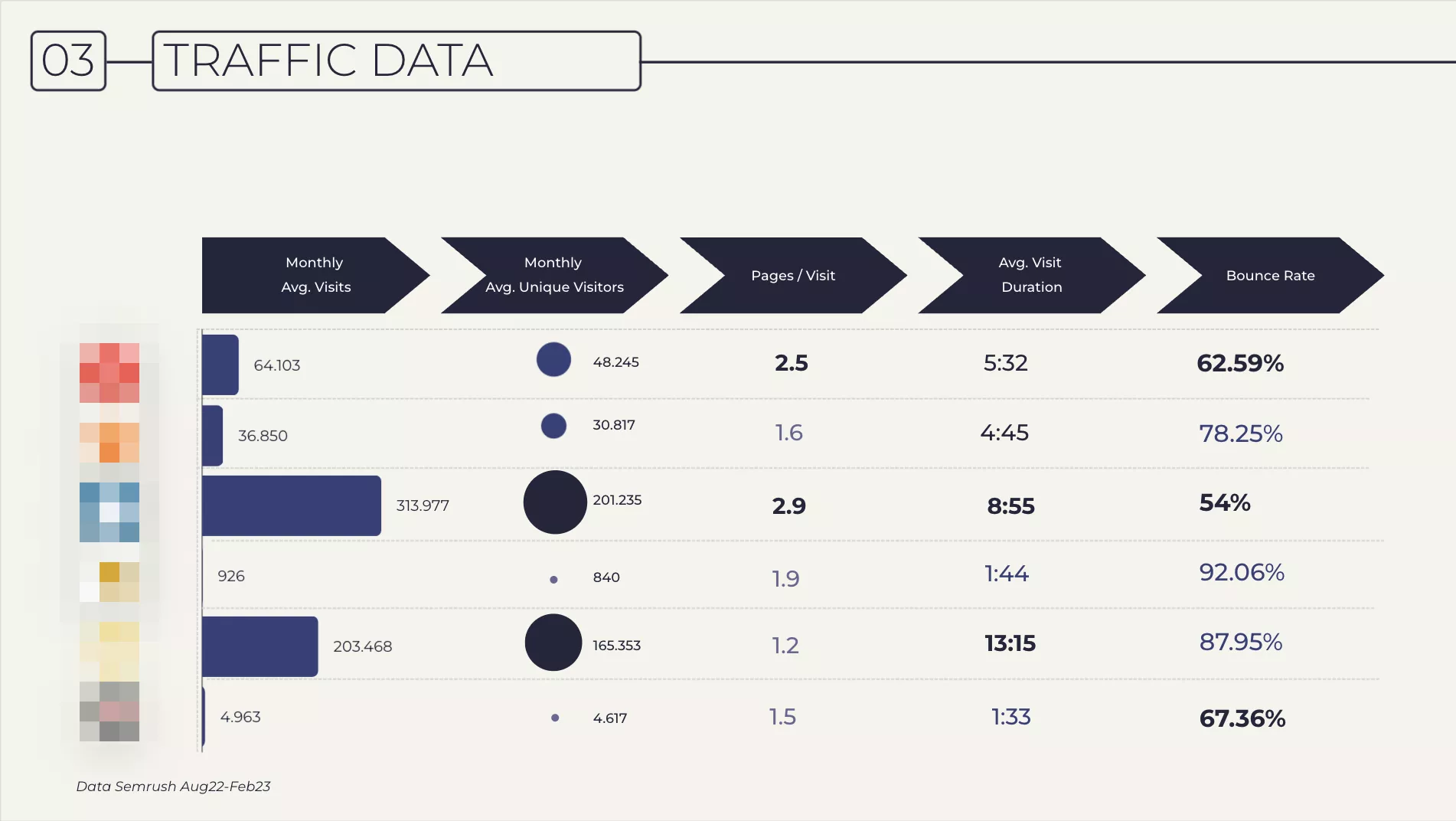

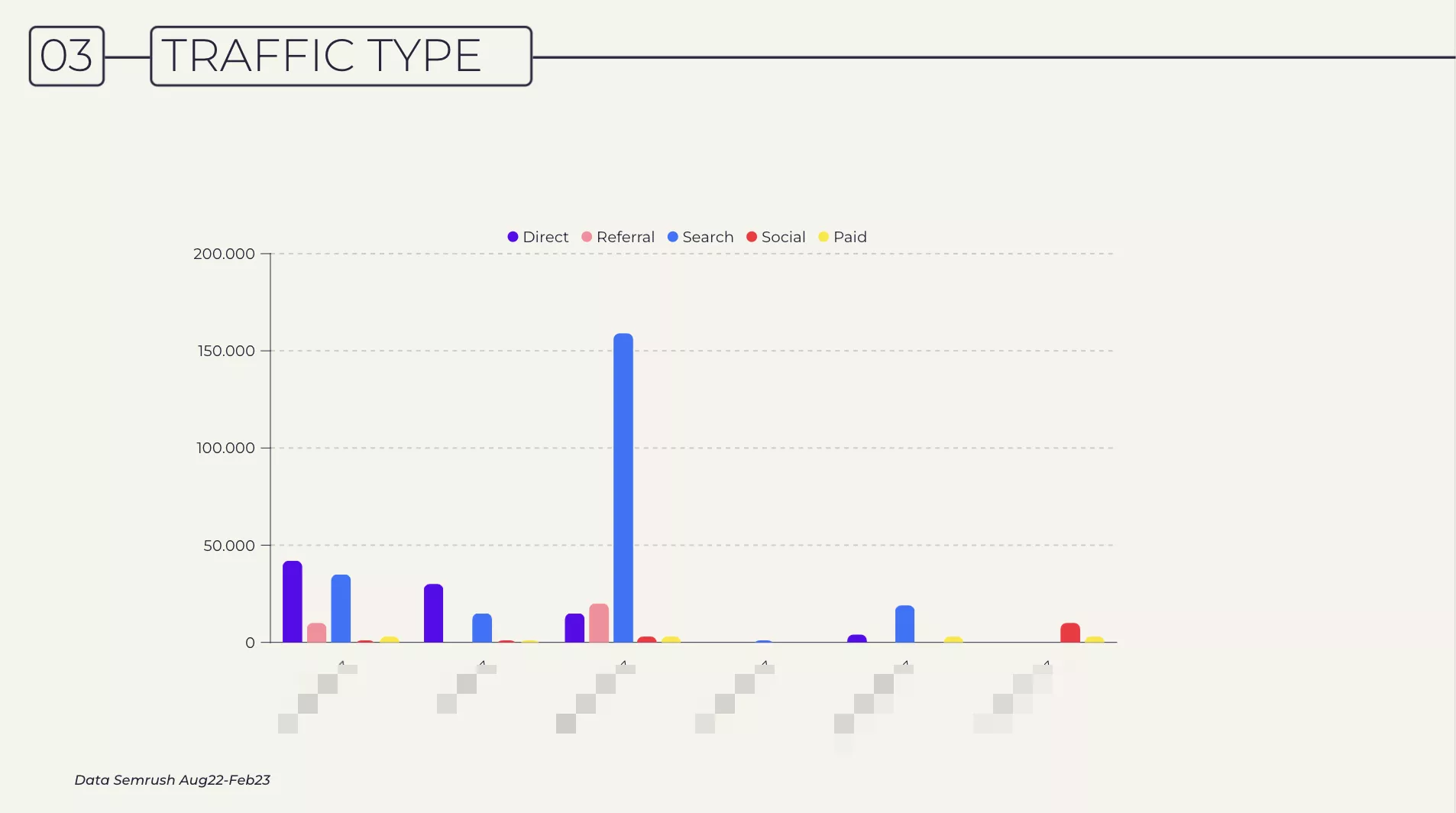

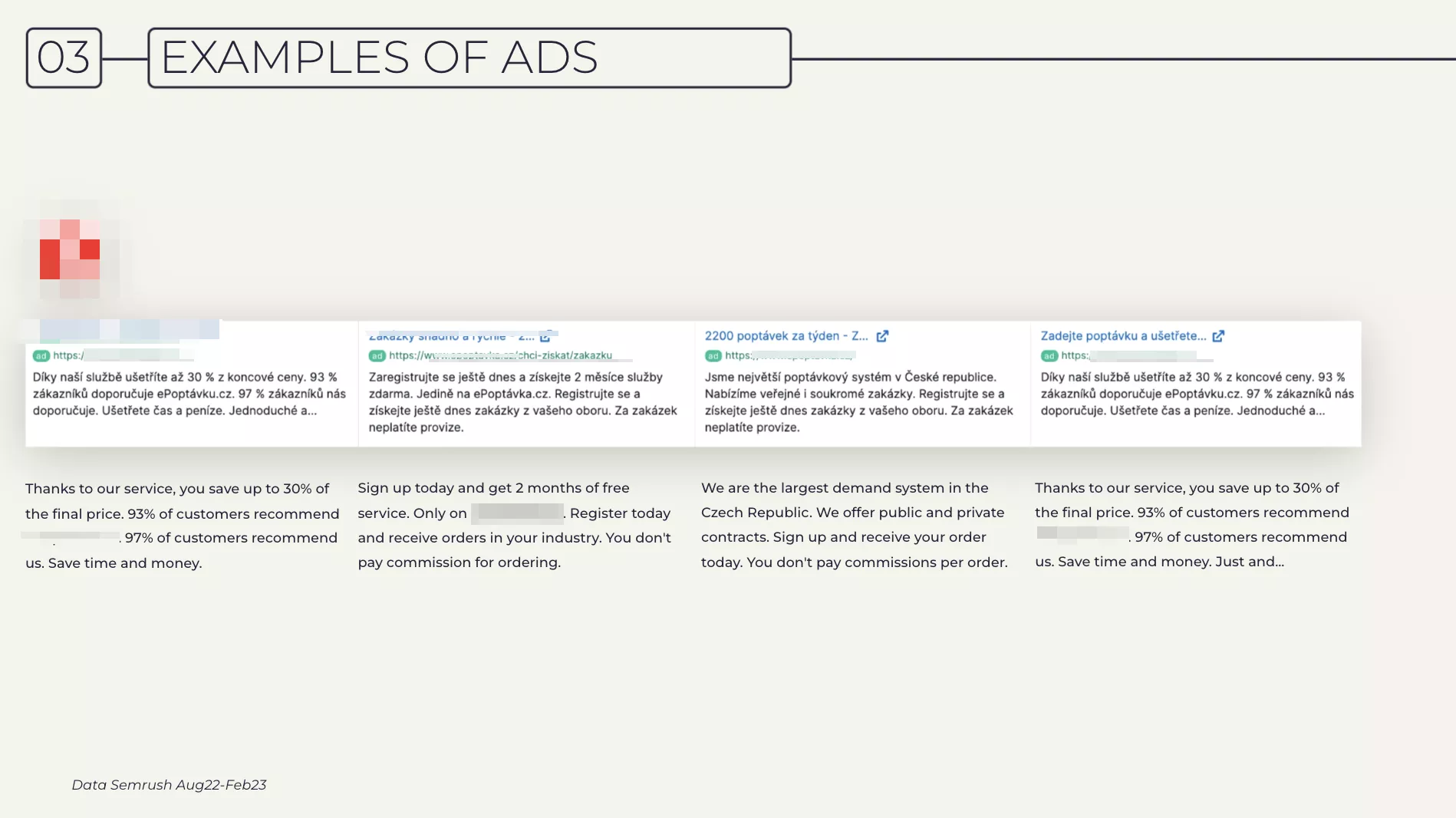

The second stage involved selecting direct competitors and researching their digital traffic, key messages, traffic channels, and social media.

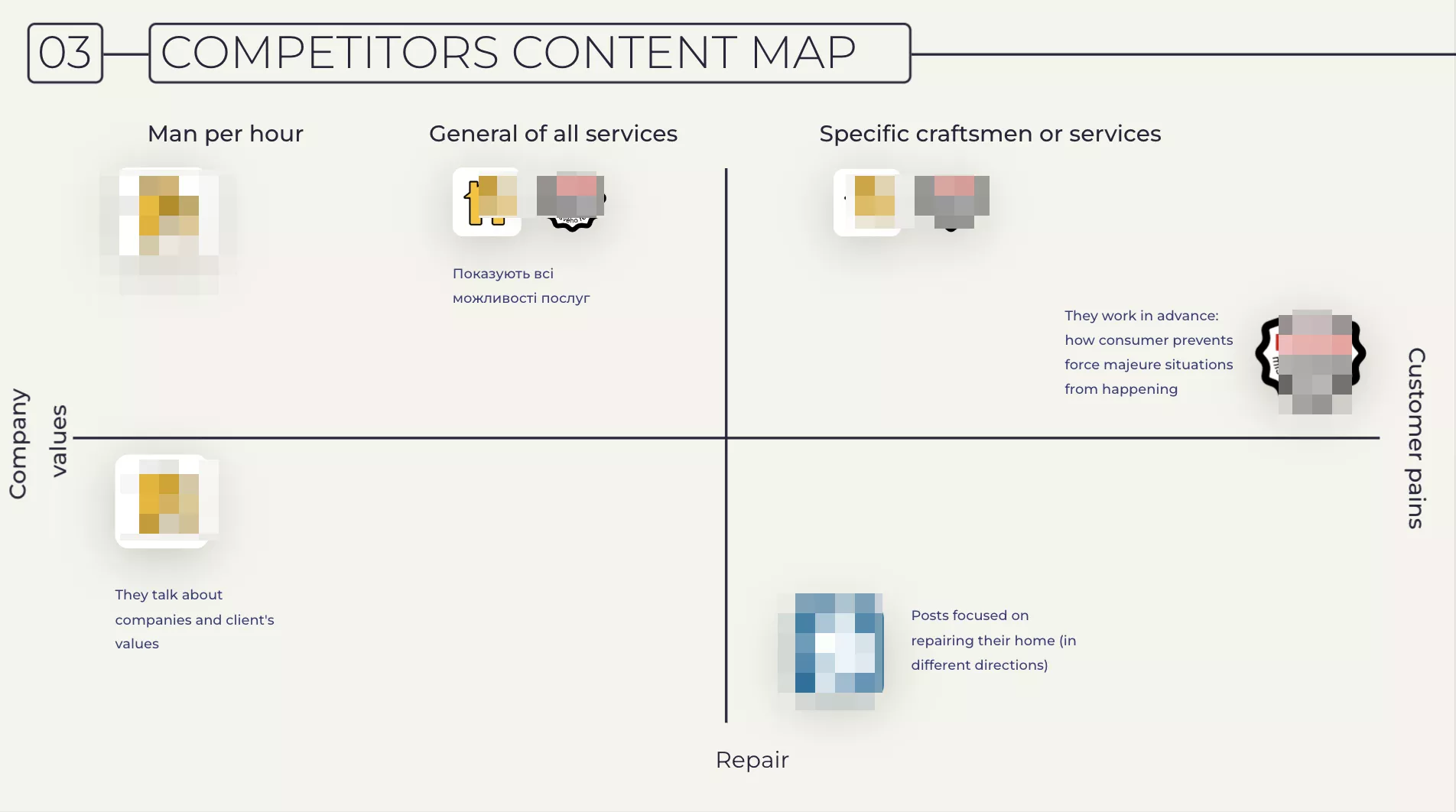

Based on the collected data, we developed a content map for each competitor, showing the key message areas that the competitor used most frequently.

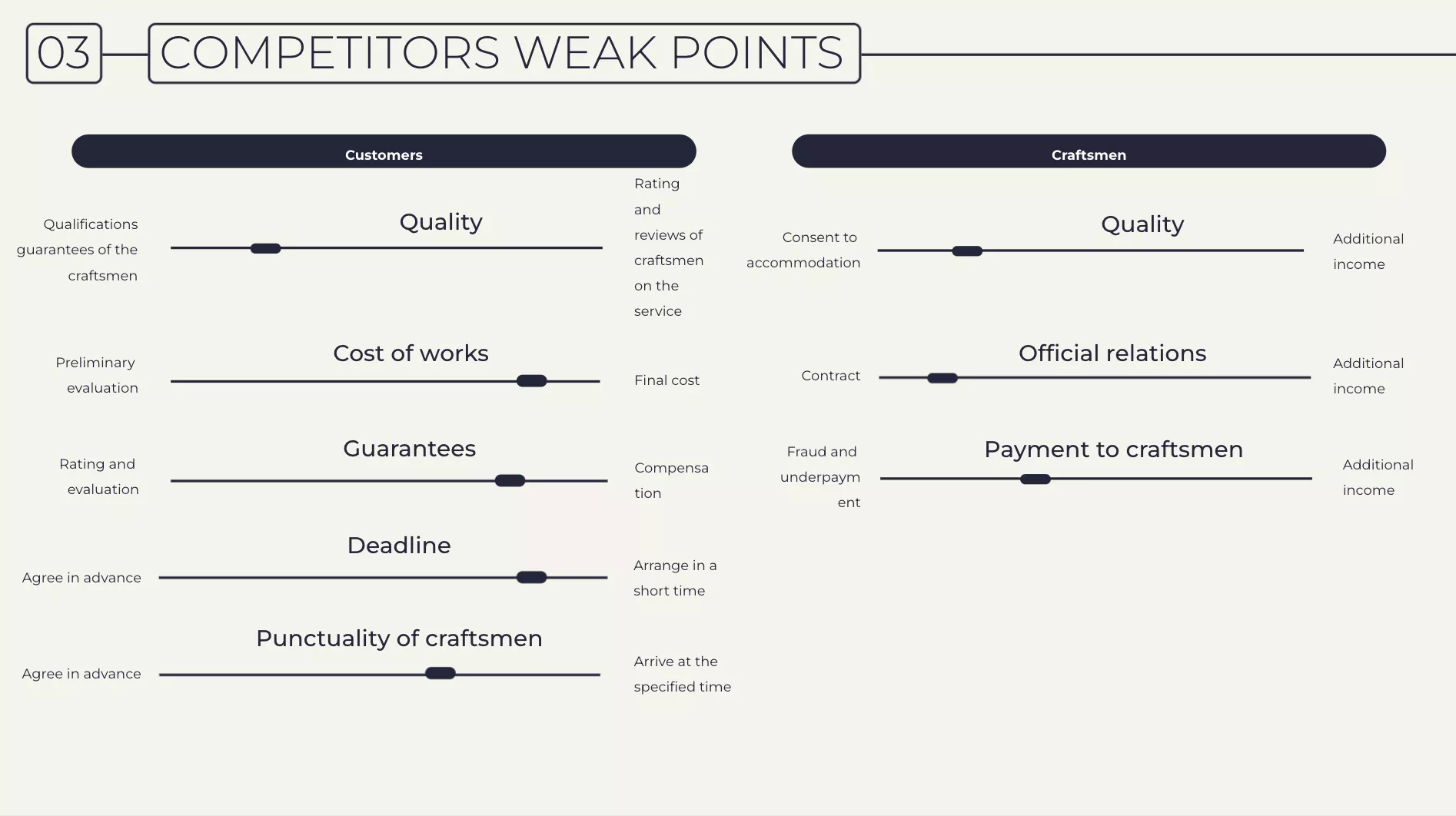

As a result of the competitor analysis, we made a map of strengths and weaknesses.

4. Audience analysis

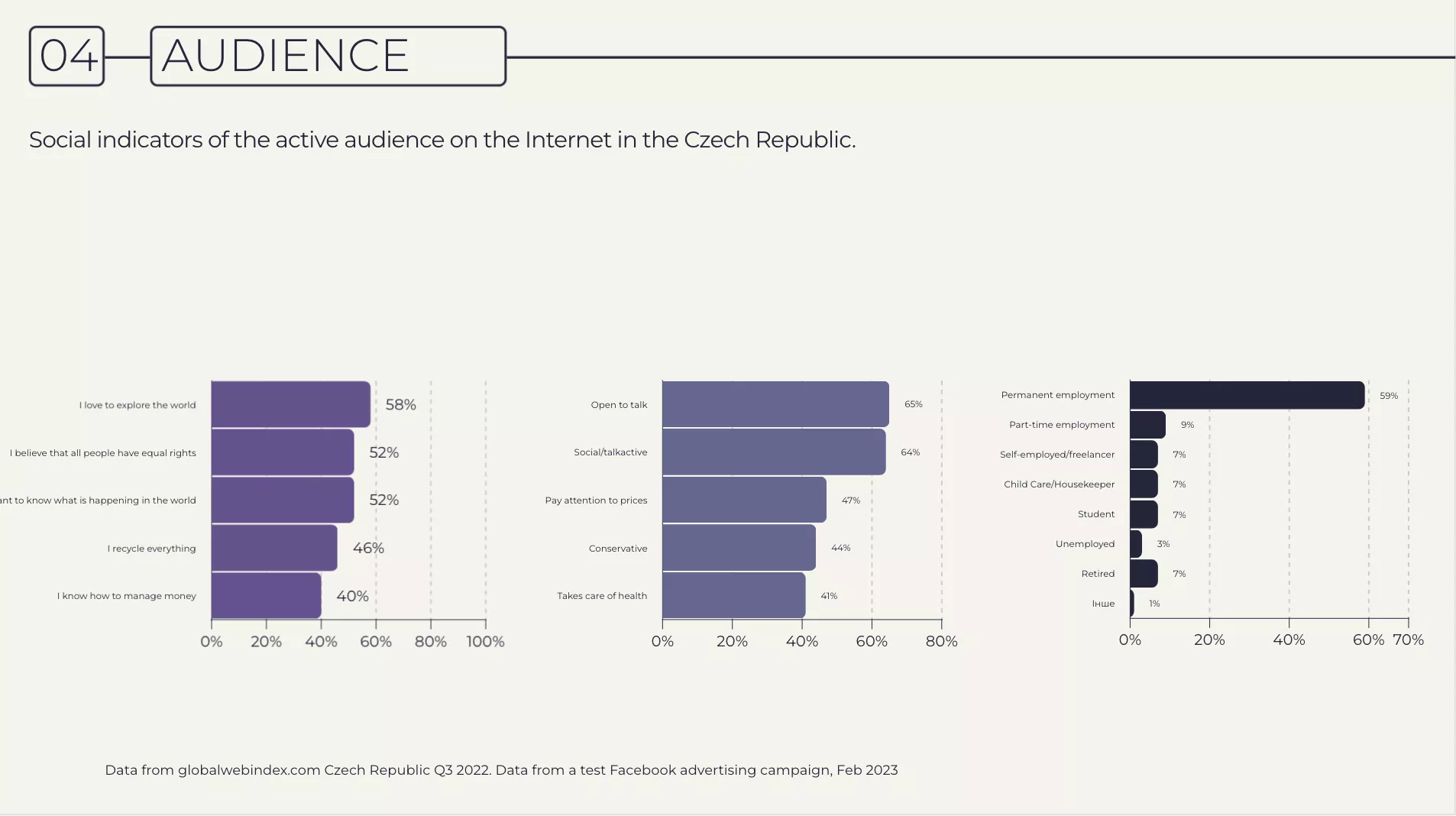

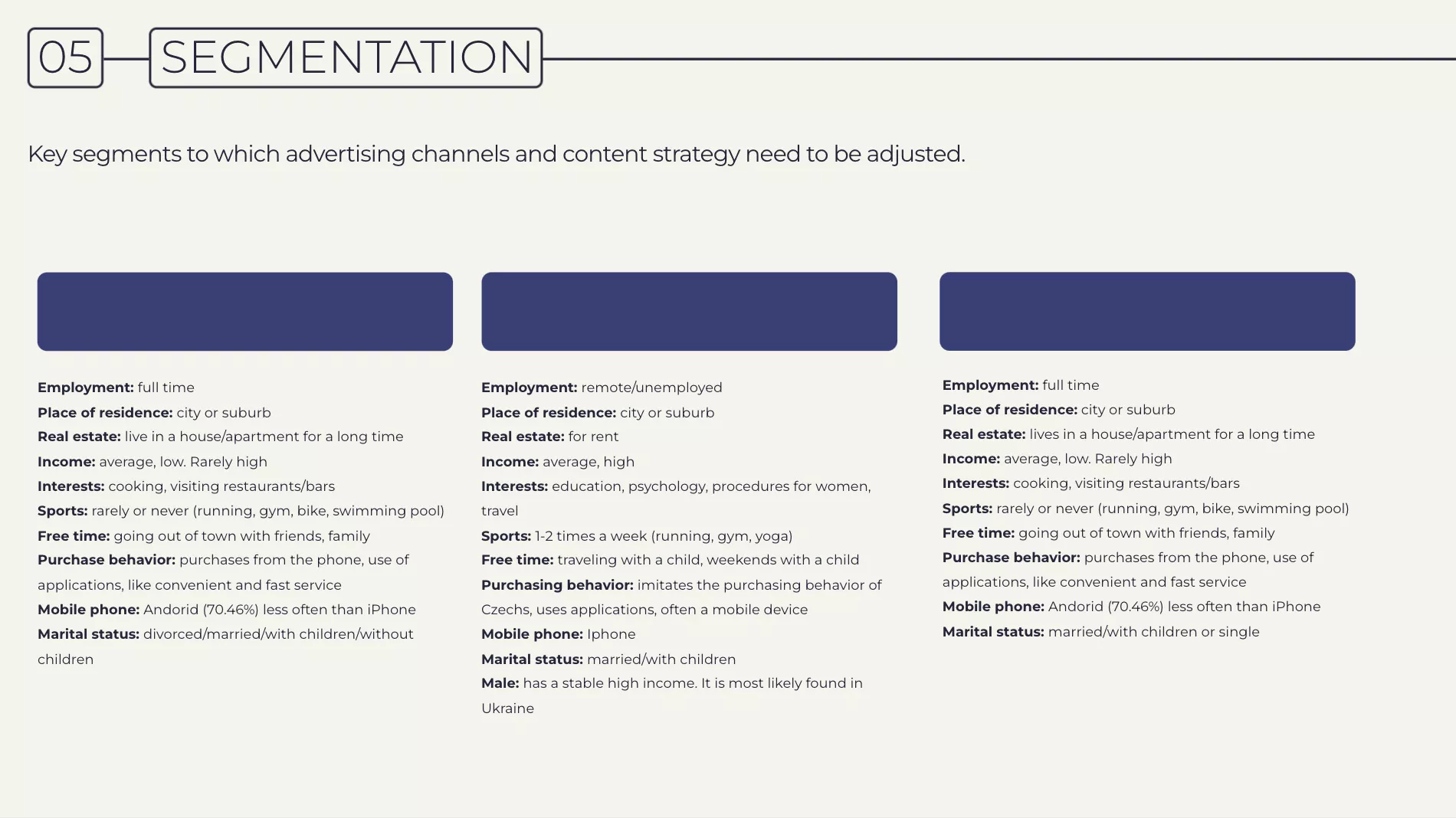

Audience analysis was conducted using the following tools:

- Traffic indicators of competitors' websites (visitors to competitors' websites, and their demographic, social, and behavioral interests).

- Statistical data about the target audience.

Key consumer pain points and barriers were used to segment the audience and create a buyer persona.

5. General recommendations

We also provided the client with a customer journey map and recommendations for project development.

Market analysis results

During the analysis, we provided recommendations on the priority actions for launching a new product on the Czech market.

We were able to answer the following questions:

- What external factors influence the product on the market?

- What is the size and potential of the market?

- How saturated is the market with competition, and what are the consumer requirements for the new product?

The client received clear recommendations and a vision of the market, and they adjusted the project development path accordingly.

Testimonials

Bohdan Mantula, middle digital strategist at Netpeak

A detailed briefing with the client helped us identify the business objectives and issues the client wanted to address. This resulted in a pool of hypotheses to be tested and an understanding of the priorities for the analysis.

During the analysis itself, we identified additional factors that could affect product promotion, such as real market volume, demographics, hidden competitors, etc. Thanks to an in-depth analysis and discussion with the client on all aspects of the market situation, we were able to make clear recommendations for the further development of the project.

Artur Boblak, founder of CRAFTER

Actually, everything went great. Thanks to the Netpeak team, we have learned a lot of new and helpful information. Now it is important for us to study all of it in detail, and we do not exclude the possibility of further cooperation.

Related Articles

Display Advertising Effectiveness Analysis: A Comprehensive Approach to Measuring Its Impact

In this article, I will explain why you shouldn’t underestimate display advertising and how to analyze its impact using Google Analytics 4

Generative Engine Optimization: What Businesses Get From Ranking in SearchGPT

Companies that master SearchGPT SEO and generative engine optimization will capture high-intent traffic from users seeking direct, authoritative answers

From Generic to Iconic: 100 Statistics on Amazon Marketing for Fashion Brands

While traditional fashion retailers were still figuring out e-commerce, one company quietly revolutionized how U.S. consumers shop for everything from workout gear to wedding dresses